Yves is Flinks' Content Strategist. He tells the world about the dramatic changes happening in finance, one story at a time.

Is Your Current IBV Provider Worth Sticking With?

You’ve been using the same IBV provider for years to underwrite loans. Their product is familiar to your team—quirks and all. They might even be nice when you email them for support. But they’re probably hurting your bottom line.

Here’s how to know if it’s time to switch.

Truth is, not all IBV providers are created equal. The process might be similar—find your bank, connect your account. But the quality of their service impacts both your cost of acquisition and your default rates.

There is so much more an IBV provider can (and should) do beyond access to raw financial data.

Today, we’ll show you what to look for in an IBV provider. With the right service for your business, you can optimize your cost of acquisition and default rates, as well as make more informed underwriting decisions faster—you know, run a better business.

3 metrics to compare your current IBV provider

1. Conversion rate

Conversion rate is one of the most important metrics to consider.

A successful conversion means your IBV provider got a borrower to connect their accounts and returned the financial data needed to process their loan.

The conversion rate you get from your IBV provider is a good measure of just how reliable they are at doing the job you hired them for.

To be fair, a number of things can go wrong when attempting to verify a bank account:

- Blocks. The connection can’t be made to the financial institution.

- Technical difficulties. Downtimes, service disruptions, and glitches prevent the IBV provider from connecting.

- Drop off. The user ends up leaving the account connection experience (there’s a whole section on this below).

It’s not uncommon to hear certain IBV providers return financial data on time 30 to 40% of the time. They’re successful, on average, for about 1 in 3 potential customers.

How Flinks can improve your IBV conversion rate

Any improvement of your IBV conversion rate is a substantial lift, because it means you get to move the loan underwriting process forward for more borrowers. And it also means fewer potential customers are left hanging.

Our tech teams are obsessively focused on performance and reliability. And the results show: for the top 15 financial institutions in North America, our average success rate is around 90 to 95%.

One of the strategies we use is to build, maintain and monitor our own connections to specific banks and credit unions—those we know will impact your business the most. This helps ensure greater success rates on each connection as well as accurate and comprehensive information on bank account balance and transactions.

2. Drop off rate

When a potential borrower is asked to connect their bank accounts and end up not going through the whole process, that’s considered a drop-off. You then probably have to go the manual or traditional route to collecting their financial information—if the borrower didn’t take their business somewhere else.

At first, it might seem hard to understand why users drop off, but it basically comes down to two factors: is it easy for borrowers to find and connect their accounts? And can they trust the process?

Want to learn more? We’ve written a short guide on reducing user drop-offs.

How Flinks can help improve your drop-off rate

Your borrowers’ experience needs to be straightforward, secure, and cohesive with your business.

We built an industry-leading account connection experience so you don’t have to. It’s blazingly fast with a modern look and feel, offers a simplified ‘find your bank’ screen for ease, and manages MFA tests—no more falling through the cracks.

It was recently updated, and has been proven by a sample of early testing clients to improve adoption by 20 to 30% compared to other providers’ account connectivity experiences.

3. Speed and accuracy

Lenders are increasingly relying on near term cash flow analysis to make their underwriting decisions, but they still struggle to extract other critical information from their customers’ banking transactions.

This is, unfortunately, where typical IBV providers exit stage left. Some don’t provide any kind of categorization. And those who do haven’t built their product to support fast and clear decision-making.

How Flinks’ data analytics can help

This is a large topic, one that we’ve written articles and white papers on, but here’s the tl;dr version.

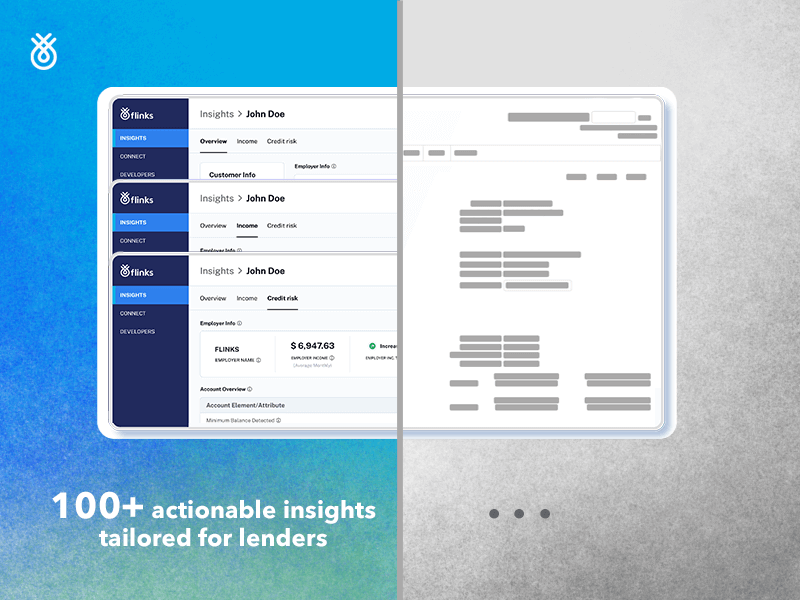

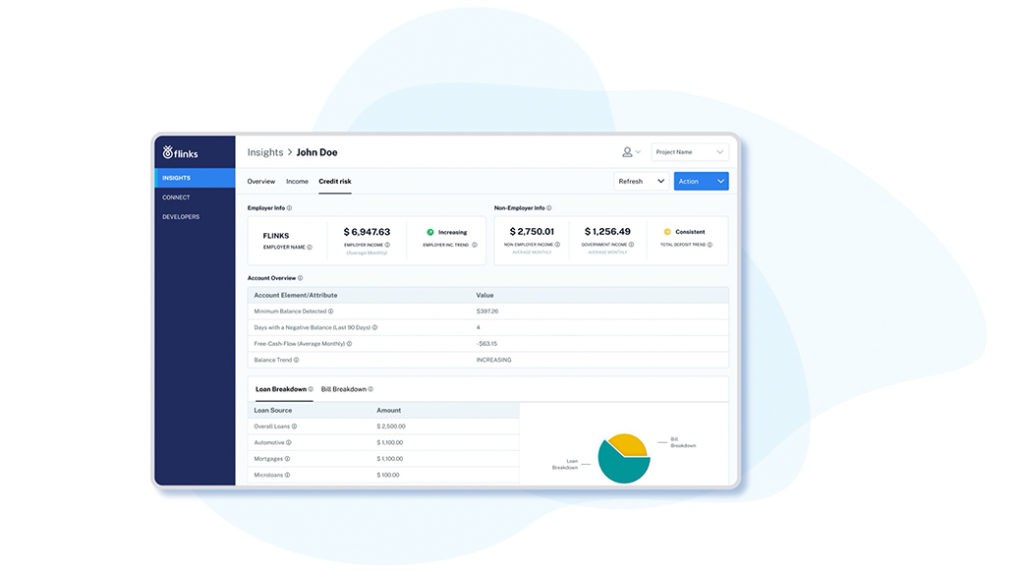

We turn raw data into actionable insights and package them in interactive visual reports—allowing your underwriters to work faster while also considering additional risk factors.

Flinks’ IBV platform not only aggregates bank-sourced data directly from FIs, but also uses an improved analytics engine that returns full-fledged data points. This includes # of NSF and # of stop payments, outstanding loans (and the lenders they’re owed to), employment and non-employment income streams (and how they trend over time), just to name a few.

Using Flinks’ data tools for lenders, your underwriters make faster and accurate income assessments, as well as credit risk and fraud analyses using interactive visual reports showcasing more than a hundred tailored, actionable insights.

Switch to a better option: test and compare

Playing table stakes simply because your current provider does the job can potentially result in lost opportunities when it comes to product innovation and borrower experience. One top motivation for switching an IBV provider is performance, and Flinks helps you make the switch as easy as test driving a car.

Test Flinks’ end-to-end solution: easy 1-2-3

Regardless of your tech resources or capabilities, the easiest way to set up a test environment for Flinks and prepare to make the switch is through our all-in-one turnkey solution designed for lenders and customizable to your needs.

Here’s how it works:

- Flinks helps you set up a private instance for you to pilot our IBV and analytics platforms with no integration.

- You can then have access to Flinks’ Client Dashboard, where you can directly invite customers via borrower links and enable your agents to consume analytic report output.

- To test the performance, run end-to-end requests with real accounts if you have live borrowers; if you don’t have live customers, we can use synthetic data or retro data.

If you are feeling intimidated, don’t be. At Flinks, we believe that it’s our job to set you up for success so that you can focus on delighting your customers. We have experience working on integration with third-party LOS and LMS systems so that you don’t have to. We are also proactive in our training on how your team can handle all end-user concerns and questions to build trust, security, ease, and transparency.

You might also like

Optimize your loan underwriting with Flinks IBV & Analytics platforms. With coverage on over 10,000 financial institutions in the US & Canada, Flinks helps you approve more loans, faster.

Attributes: Financial Data Enrichment

Businesses collect data faster than they can make sense of it. Attributes’ unique data enrichment and analytics engine delivers actionable, model-ready insights each time customers connect their accounts.