Yves is Flinks' Content Strategist. He tells the world about the dramatic changes happening in finance, one story at a time.

Introducing the Mortgage Package: Data Tools to Power Your Digital Mortgage Experience

A mortgage is the biggest debt most of us will ever carry. Brokers, lenders and mortgage platform operators must meet high regulatory compliance standards and manage risk efficiently. But this has traditionally caused delays and friction for hopeful homebuyers.

We’re introducing a set of data tools to power a faster, more convenient and truly digital mortgage experience — all while enabling you to fulfill major compliance requirements more efficiently.

Quick links

- Build your audit trail

- Enhance your client experience

- Power and speed up your underwriting process

- Execute successful digitization initiatives

- How our clients are using the Mortgage Package

Build your audit trail

Let’s first get something out of the way: in the past, you were not able to easily source official bank statements from your clients’ accounts using financial data connectivity.

Now, when a client authorizes a connection with Flinks, their original bank statements become automatically available on the Portal or via direct API, in their native PDF form — along with the rest of their personal information and financial data.

This is a straightforward and convenient way to build your audit trail. With a single connection, you can collect up to 12 months of original bank statements — which means you don’t impose on your clients to retrieve these documents themselves and share them with you.

Additionally, since the PDF documents are sourced directly from the bank, they can’t be tampered with.

Enhance your client experience

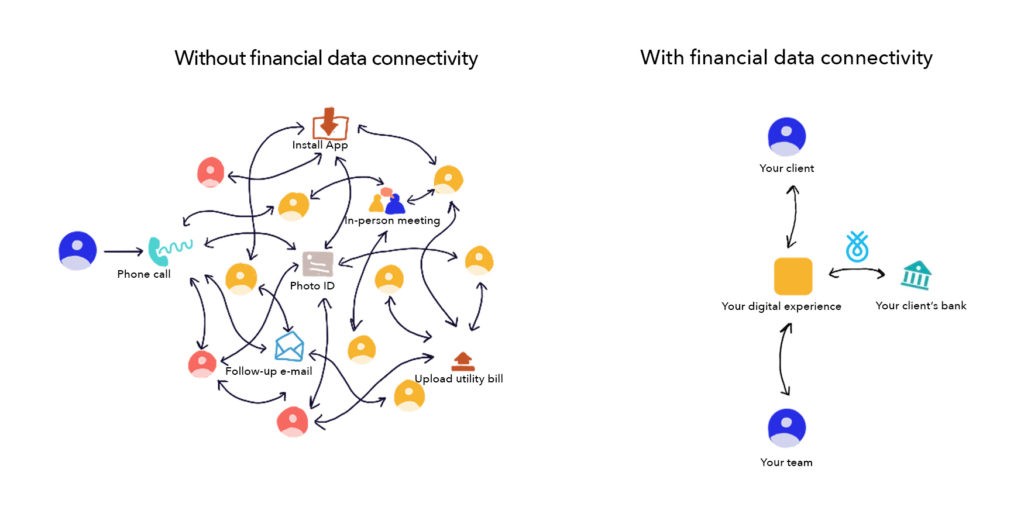

A significant part of the interactions between a mortgage professional and a hopeful homebuyer involves gathering information and sharing documents to build the application file. This process can span over many days — a period during which the client is likely to engage with other brokers.

You can drastically simplify and accelerate the process of building your clients’ files by sourcing personal information and financial data from their bank.

Financial data connectivity reduces the constant back and forth to a minimum, by introducing a single data pull from your clients’ bank accounts.

Within minutes, you have access to KYC and account-level information, as well as up to 12 months of raw transactional data and original bank statements. (See the full list of data categories here.)

Expedite a time-consuming process, and allow your mortgage professionals to deliver a richer, more engaging experience to your clients — by spending more time answering questions and providing timely advice.

Power and speed up your underwriting process

Gathering information and documents is just a start. Then, analysts assess the quality and make sense of this pile of data.

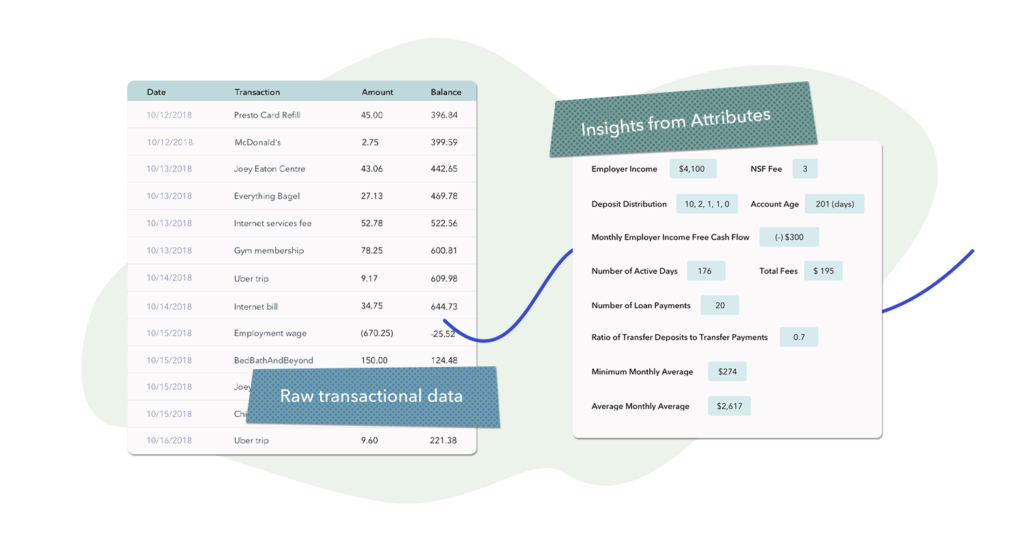

Our data enrichment tool Attributes replaces repetitive tasks associated with creating and understanding a mortgage applicant’s financial profile.

Attributes ingests raw transactional data sourced from the bank and instantly extracts the usables insights you need to power your underwriting analysis.

It basically provides the structure to understand your clients better.

How much risk mortgage lenders really take lies in the quality of the data collected for the underwriting process.

With Attributes, you have access to specific sets of data points that together provide a comprehensive, accurate and up-to-date understanding of your clients’ financial situation.

- Income detection

- Credit risk analysis

- Fraud analysis

- Deposit analysis

- And additional custom data attributes as needed

Execute successful digitization initiatives

Across finance, the desire to drive digital transformation is widespread — but so too is the struggle to successfully execute digitization initiatives. That’s why our teams work obsessively to bring down the barriers to using financial data.

Now, you can deploy our data tools in a matter of days, using little — if any — tech resources.

Head this way to find out how we can accelerate your digitization initiatives with rapid no-code deployment and useful data visualization options.

How our clients are using the Mortgage Package

Whether they need to accelerate a single step of their application process, or create a convenient end-to-end experience, our data tools have become integral to our clients’ digital mortgage services.

Gather and analyze data faster, while building your audit trail

Most of our clients use all the elements of the Mortgage Package. This option offers the most seamless experience throughout and can be deployed in a matter of days with little — if any — tech resources.

1. Get started quickly

Our Flinks Hosted Solution lets you deploy bank account connectivity without a single line of code.

2. Visualize your customers’ information

Attributes reports are generated directly in the Portal. Simply log in to access and visualize your customers’ data.

3. Build your audit trail

When a customer connects their bank account, official bank statements become automatically available in the Portal, in their native PDF form.

Power your mortgage platform with a custom API integration

Some of our clients use our data tools as part of their own fully customized experience. What they are building are effectively an integrated digital process between brokers and lenders, enabling the former to collect information and documents that are then sent to the latter to close the adjudication process.

1. Gather information and documents faster

Gather both information and native bank statements in one data pull.

2. Receive actionable data

Get structured, enriched data fed directly into your CRM, and start using it right away.

3. Simplify communications with lenders

Generate your own comprehensive reports using data points extracted from your customers’ transaction history.

NB: The information in this article is not intended to replace any advice from your legal counsel.

You might also like

Introducing Digitization in a Box: The Road(map) to Digital Just Got Shorter

We’re rolling out two features allowing you to collect all the data you need, and visualize it, without having to constantly involve tech teams.

Move Fast, Make Things: Live and On-Demand Webinars to Accelerate Your Digitization Initiatives

It’s never been more critical to do digital right — and there’s never been a better time to give a helping hand. We’ve gathered the top minds in the financial industry to help accelerate your digitization initiatives.