Annahita is a content and brand marketer who enjoys writing about the transformative power of Flinks and the fintech space. When not telling Flinks' story, you can catch her reading, travelling, and fostering kittens

Mitigating Fraud in the Canadian Real Estate Market – Treefort + Flinks

Treefort Technologies is on the front lines helping to mitigate fraud using cutting-edge technology. With a current focus on the Canadian real estate market, Treefort is using technology to help lawyers, notaries, lenders, and business professionals meet their compliance and verification requirements and avoid involvement in fraudulent transactions.

As the first product in Canada that provides identity verification, fraud risk and anti-money laundering assessments in one place, they were looking for a reliable and proven partner that could easily integrate into their platform and support their banking verification process. That’s where Flinks came into the picture.

Treefort’s Multilayered Compliance with Canadian Client ID Rules

*As one of the verification layers, Flinks helps power Treefort to reach their 98.3% overall compliance rate.

CHALLENGES:

- Finding a secure and reliable financial data aggregator connected to the most Canadian financial institutions

- Ensuring the financial technology solution has the highest quality compliance and verification standards

- A solution that easily integrates into Treefort’s multilayered platform

SOLUTIONS:

- Flinks’ proven track record in Canada ensured reliability and quality of bank data and reporting

- Flinks Enrichment allowing customization of attributes to support fraud risk detection

- Flinks’ API seamlessly integrated into Treefort’s comprehensive fraud mitigation platform

Treefort faced 3 major challenges

- Strong Canadian network

Treefort needed a solution that had access to both major and long tail financial institutions all across Canada, not just specific regions.

- Technology integration

As a multi-layered platform, Treefort needed a financial technology partner that could be easily integrated into their product.

- Custom enrichment

Raw bank data needed to be cleaned and enriched for accurate and timely reporting.

Layering technologies to catch the fraudsters

Canadians must arm themselves to combat cybercrime fraud. Treefort began as a way to simplify and streamline identity verification, but has since evolved into a platform that’s become the gold standard in digital ID technology in Canada.

Before lawyers, notaries, title insurance companies and others do business with an individual, Treefort provides them with the technology they need to verify the identity of that individual and make sure that they’re dealing with the correct person. To do this effectively, the Treefort platform layers multiple technologies on top of each other, which includes Flinks. They then triangulate all of the relevant data using their patent pending algorithms to ensure technical accuracy for the verification and compliance reports.

Treefort only works with the best in class service providers, which is how Flinks came to be their partner of choice for banking verification. Flinks provides a way to check and balance against our other types of technology in order to assess whether an applicant poses a major risk as a potential fraudulent transaction, or if they pose a lower risk.

Keep in mind that most people are not fraudsters, but the number of fraudsters is increasing rapidly. The easy access to technology enables these criminals to generate fake IDs that are impossible to detect visually, making these fraudsters so confident that they’re willing to meet in person or online. In fact, recent reports in the media where people have had their houses sold out from under them involved fraudsters meeting in person.

Treefort is working to balance the scales in favor of honest transactions, giving fraudsters less opportunities to capitalize on gaps in the identity verification system. They stand apart because there is no other technology that offers as many integrations in one place as they do. No technology is foolproof, but Treefort, through partnering with top of class partners such as Flinks, are the best technology on the market today that can detect and mitigate fraud.

Despite the effectiveness of Flinks, Treefort is constantly looking for new technologies to enhance their capabilities and stay ahead of the fraudsters, which is why they are so keen on the rollout of Open Banking in Canada.

“We’re all waiting for Open Banking. And we know that as soon as Flinks can get Open Banking, we’ll be in there and we can’t wait for it.”

– Jay Krushell, Treefort Cofounder and Chief Legal Officer

Identity verification complemented by Flinks’ API

Treefort identified a gap in identity verification and fraud risk assessment in Canada, which is when they began looking for technologies to enhance their fraud mitigation capabilities.

When searching for companies that provide comprehensive banking verification in Canada, options were limited. That was until Treefort discovered Flinks. Treefort appreciated the fact that Flinks provides banking verification across all financial institutions, ensuring a larger scope for their reporting.

As part of Treefort’s multi-layered approach to fraud detection, Flinks’ API was easily integrated into the Treefort platform. Treefort and Flinks work as complementary technologies, taking the best that each has to offer and coming together to collectively stop fraudsters.

If fraudsters make it through the first stage of the selfie ID technology with their fraudulent ID, Treefort steps in to provide an added level of protection against fraudulent transactions. That’s why you have to have so many different technologies to confirm a person’s identity, and why technologies such as Flinks serve as a crucial layer.

“Flinks is part of that layering of the technologies that we need to combat fraud.” – Kim Krushell, Treefort Cofounder

– Kim Krushell, Treefort Cofounder

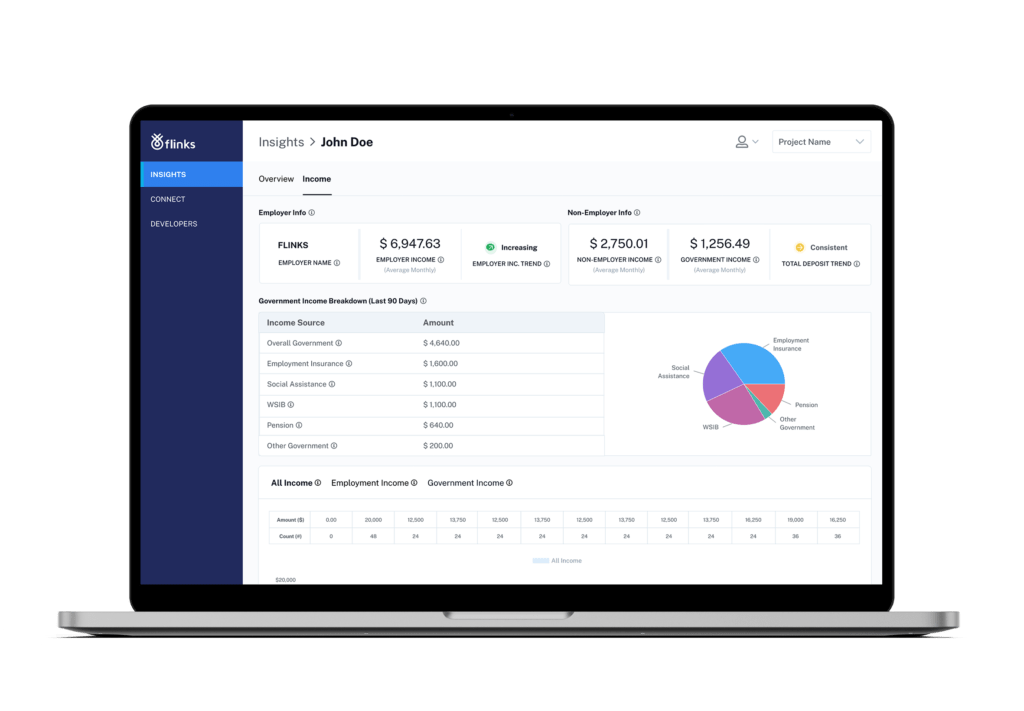

*Sample Flinks Enrichment dashboard.

Catching fraudsters using Enrichment

Treefort has successfully stopped fraud, with Flinks playing a key role in this success. Without going into Treefort’s specific technological capabilities, it’s important to note that they have made the most out of Flinks Attributes, building out a customized way of taking raw data their system captures and having it cleaned and enriched to specifically look at key fraud risk indicators.

Flinks’ broad network of financial institutions also provides Treefort critical insights into a person’s financial history that go beyond the conventional credit score measure. This helps Treefort support private lenders and other entities to address and dig deeper into applicants’ financial histories.

They’ve also narrowed down all the attributes that Flinks offers and picked Attributes that help enhance their capability to mitigate and identify fraudsters. This customization has been integral to the accuracy and breadth of Treefort’s reporting.

Consider the age of a bank account, as an example. Once Treefort’s technology has gone through the various processes of identifying a person as a potential fraudster, there are particular Attributes that give them targeted insights and identifiable trends that are helping to catch fraudsters as we speak.

Key Takeaways

- Flinks’ technology is supporting Treefort as they become the gold standard for identity verification and fraud mitigation in Canada

- Flinks’ wide-ranging access to financial institutions across Canada complements Treefort’s ability to catch fraudsters

- Customizable Attributes help Treefort take the raw banking data they are capturing and use it to identify fraud risks

Conclusion

Treefort is planning to roll out a second product in the coming months, a video meeting electronic signature system, which will further enhance their fraud mitigation capabilities. They continue to work to provide solutions to counter fraud, working with government entities and law enforcement agencies to prevent fraud and ensure the safety of individuals and businesses. And Flinks is right there supporting them.

You might also like

Simplifying and Streamlining Estate and Trust Administration

Find out how partnering with Flinks helped Estateably modernize estate processing and propel them to the top of the Canadian market.

Providing a Smarter Car Buying Experience

See how Flinks helped CarEvo embrace financial digitization and grow to be the #1 car dealership in Atlantic Canada.