Flinks gives you the power to build the future of finance. Connect, enrich and utilize financial data to delight your customers with amazing products.

Open Banking in Action – A Look at Use Cases

Open Banking comes in many forms, but at its core, is a secure way to give third-party service providers user-permissioned access to banking, transactional, and other financial data from financial institutions (FIs) through an application programming interface (API). The benefits of Open Banking go beyond convenience; they also offer ways for FIs and users to share financial data securely and can also significantly improve user experiences across a wide variety of applications.

Open Banking can be done in two ways: “data-out” and “data-in.” At its simplest, data-in is the intake of financial data from an FI for the purposes of providing a service or experience. Data-out is when an FI that is hosting financial data shares it with third-party service providers.

Understanding how Open Banking works at a high-level is helpful, but what’s even better is seeing how these two different types of Open Banking options can be put to work right away. We’ll dive into the most relevant Open Banking use cases for FIs in this article, and also discuss how FIs can upgrade their digital experiences to maximize conversions and gain a competitive advantage.

Data-in use cases

Let’s take a look at all the ways data-in Open Banking can be put into action by FIs with some specific use-cases.

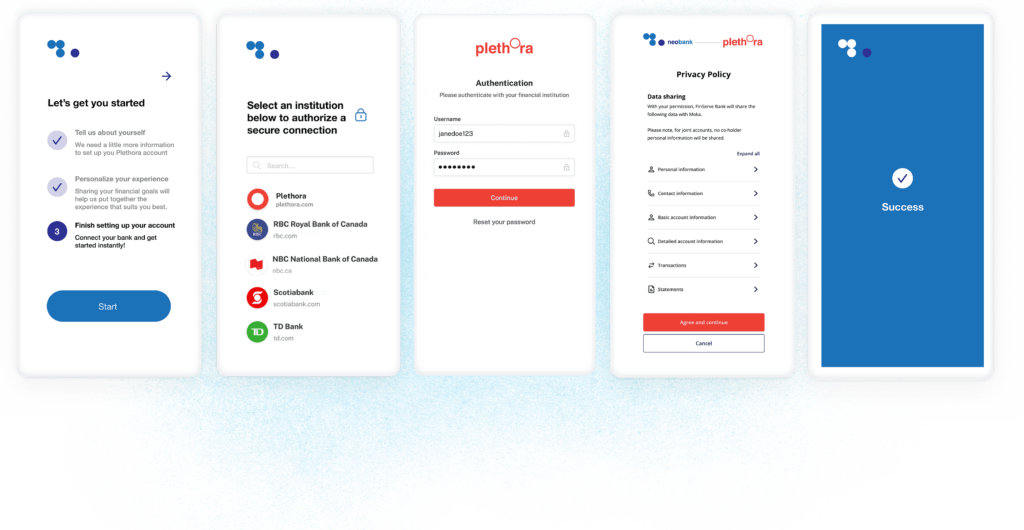

Onboarding and KYC

Onboarding often requires customers to first validate their identity (for AML compliance/KYC) and second, set up a micro-deposit in order to validate an applicant’s account. To get their routing numbers, some customers are also required to upload an identity document or PDF statement of their account. All of this adds up to a bulky onboarding process that isn’t optimized for success. That’s where data-in Open Banking comes in.

By directly connecting users’ bank accounts through data connectivity, applications can receive KYC data (such as names, addresses, and so on) in real time. Connectivity also facilitates the effortless collection of payment data such as routing numbers, removing the need for document uploading.

There are multiple benefits to incorporating data-in connectivity for onboarding and KYC, including:

- A simplified acquisition and activation experience for users

- A reduction in application drop-offs leading to increased conversions

- Less inefficiencies and inaccuracies, better operational efficiency

- Automation decreasing reliance on human validation

- Modernization of signup flows

- Better digital banking and product offerings

Loans and underwriting

Traditionally, loan underwriting is done using manual documents provided directly by a user. Users provide pay stubs, income data, employment letters, and other documents as required, which lenders then cross reference with a credit score from an accredited credit bureau to assess credit worthiness.

This time-consuming process is susceptible to inaccuracies and potential fraud. It also excludes many viable loan applicants whose income or employment are not accurately captured by these traditional avenues, such as gig workers or freelancers.

With data-in, underwriting is based on the financial data pulled directly from an applicant’s account. This comprehensive method captures more relevant data and factors than a credit score rating alone. Enriching the transactional data, with Flinks Enrichment for example, also helps with making the transactional readable and actionable. This gives FIs behavioral insights into applicants that are otherwise inaccessible to them.

Ultimately, instead of assessing loan candidates using static data and asking for documents that will have to be processed manually, data connectivity increases the efficiency of the loan application process. It also qualities viable candidates that would be otherwise excluded from the opportunity to access loans or mortgages that they are well-qualified for.

Payment setup and account funding

Payment setup is the process where FIs verify if an applicant’s account can receive transfers or withdraw capital, making it easy for clients to move funds between accounts. This also includes Pre-Authorized Debits (PADs) and automatic account top-ups.

Without data-in Open Banking, the current payment setup process is disjointed and adds unnecessary friction to the customer’s experience.

For example, if a customer wants to initiate a deposit into their investment account from their linked bank account, they must switch between apps, separately log in to the banking app, and then send money from their bank account to their investment account without a confirmation of the funds arrival. This often discourages customers from following through with payment setups and leads to drop-offs as customers look for better user experiences elsewhere.

With data-in, micro-deposits, Interac transfers, and manual operations can be sourced directly from the account of origin rather than as a request from the app. With data-in, clients are saved the time and headache of having to enter their account number every time they want to make a simple transfer. This allows for faster, quicker, and easier deposits, which benefits both the FIs and clients.

Data-out use cases

When FIs implement data-out Open Banking, they offer an improved customer experience while also gaining a competitive advantage through the development of key partnerships and integrations. This strategy cumulatively benefits clients while also generating more revenue opportunities for FIs. Let’s take a look at some examples:

Data sharing for retail banking

As customers increasingly maintain financial relationships with more businesses than just their primary bank, they are finding a need to consolidate, view, and manage their finances across these multiple locations.

With 57% of Canadians keen on or already connecting their banks to a personal finance management (PFM) provider to manage their finances, this is a prime opportunity for FIs to let their customers connect and share their financial data securely. If an FI enacts a simple data-out connection, such as one powered by Flinks Outbound, their clients can then see their latest banking transactions in the PFM app in real time.

Data-sharing improves the digital experience and offers better packaged services, increasing client acquisition and retention. Working with an experienced Open Banking partner such as Flinks also helps businesses quickly and seamlessly go to market with these offerings without the burden of development costs or re-allocating internal resources.

Data sharing for business banking

For business banks, data-out connections allow them to give small or medium-sized businesses (SMBs) the ability to directly access their relevant financial data and input this data into the accounting or financial management solution of their choice.

With this type of integration, SMBs will no longer have to waste time with manual reconciliations. Instead, these seamless connections save SMBs time and reduce manual errors in their bookkeeping. Real-time data syncing between bank accounts and accounting software also enable SMBs to have an up-to-date view of their financial position, helping with better cash flow management, expense tracking, and financial planning. For FIs, they can improve the digital experience, offer better packaged services, and increase client acquisition and retention.

Data sharing for private banking

Private banking brings together various financial services to provide a holistic wealth management experience for clients. Currently, due to a lack of data connectivity, advisors spend hours manually connecting and ingesting investment and other financial data from multiple banks into their financial planning tools.

Through secure data-out connection with the financial planning tools of your partnered advisors, advisors and clients are able to sync data in real-time and automate the data sharing process without manual intervention. Automating and digitizing this process also drastically reduces time spent by advisors on administrative tasks, allowing them to focus on the actual process of wealth management rather than administration. This gives private banks the ability to provide a more comprehensive and frictionless service to their clients by giving them a better overall picture of their client’s financial health.

You might also like

Open Banking: Building or Buying

Open Banking is coming to Canada in 2023, and you’ll need a solution. Read to learn 4 reasons why buying a solution may be a better decision.

OAuth Performance: Improve User Experience and Increase Conversions

OAuth allows end users to connect in seconds, not minutes. Learn how OAuth improves speed, reduces friction, and increases conversions.