Yves is Flinks' Content Strategist. He tells the world about the dramatic changes happening in finance, one story at a time.

How Financeit Uses Flinks to Power Frictionless, Insights-Driven Big-Ticket Financing

The new wave of embedded finance meets old problems with data-powered solutions that bring higher value to both businesses and their customers.

Financeit—Canada’s leading POS financing provider in the home improvement space—is a prime example.

Most consumers must obtain financing for contracts priced in the tens of thousands of dollars, which can delay or even paralyze their projects. Financeit removes that friction from the purchase, by empowering merchants and retailers with quick, flexible financing options.

“When borrowers connect with Flinks, there’s no need to find, print, and scan personal documents to apply for a loan—plus, we are using the insights we get from Flinks as inputs into our automated identity and income verification processes, which is an essential part of being a responsible lender.”

— Lee Zwaigen, VP of Product, Financeit

Financeit transformed the POS experience of thousands of merchants across the country. Since they’ve launched a white-label direct-to-consumer financing product for a major retailer’s physical and online stores, 70% of borrowers have been using Flinks to establish recurring payments by linking their bank accounts instead of uploading a void cheque.

Read on to find out how Financeit uses Flinks’ financial data connectivity and enrichment to deliver best-in-class POS financing for big-ticket purchases.

Objective

- Empower home improvement merchants with quick, flexible POS financing options

- Deliver a best-in-class loan application experience

- Contribute to minimizing default and fraud risks for sizable loans

Approach

- Embed financial data connectivity in the application experience to instantly receive account-level and transactional data

- Use bank-sourced customer information as one of many digital tools working together to confidently verify identity and income

Benefits

- Data connectivity helps avoid friction points in the application process caused by asking for void cheques and pay stubs

- Model-ready insights contribute to increasing the automation of the adjudication process

- Insights facilitate the work of analysts in cases that need manual review

Save this case study for later. Download as a pdf.

Removing friction from the point-of-sale financing equation

Financeit works directly with home improvement merchants, contractors, and retailers who want to offer their customers financing options for large-ticket items, such as a new roof or a bathroom install.

“We help merchants run their business better. Flinks helps us do that, by removing friction points so that merchants can safely and easily provide competitive loans and get to work on what they do best.”

Rather than having their customers manually apply to their banks for a sizable loan, merchants and retailers can offer financing options with flexible payment plans through Financeit. This added value and affordability for the end-consumer, delivered in a seamless, convenient and secure digital experience, gives them a competitive edge.

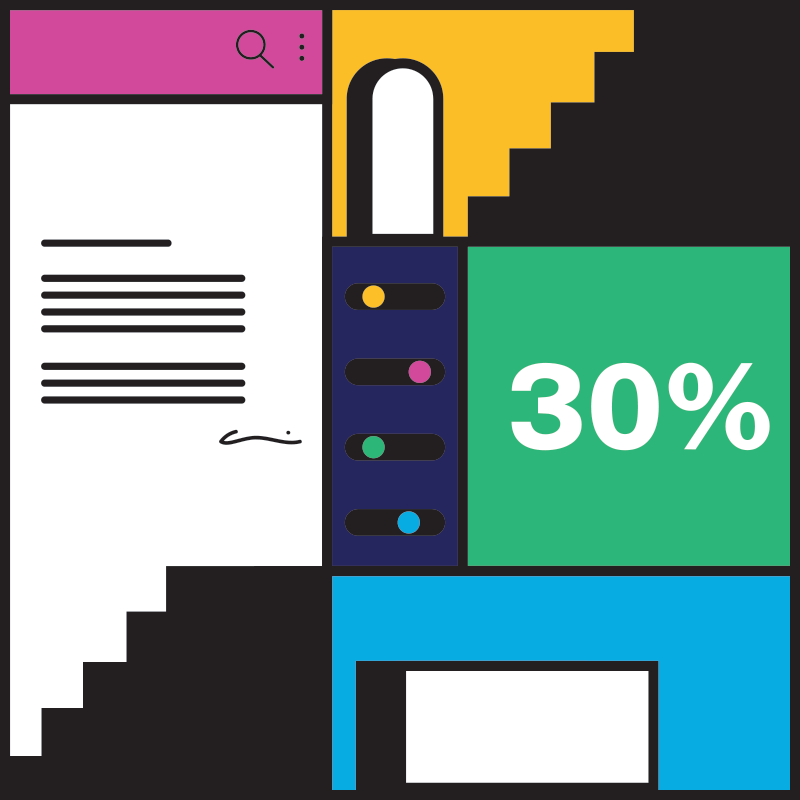

In 2020, Financeit saw a 30% increase in the adoption of digital components of their application process compared to previous years.

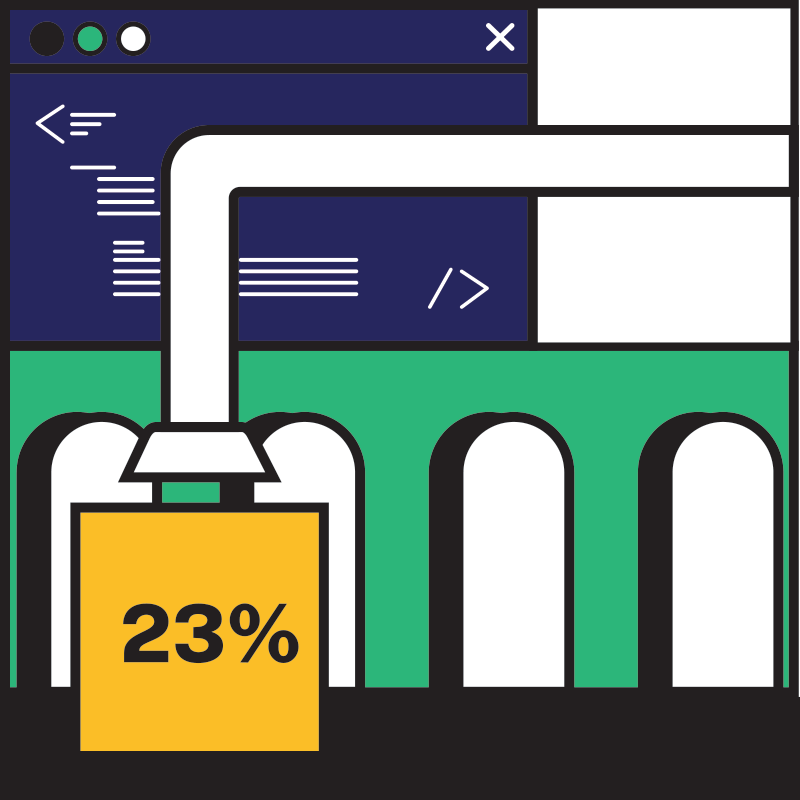

Loan applications driven by digital solutions lead to a 23% reduction in average time to complete compared to non-digital journeys.

Financeit’s frictionless POS financing experience is made possible by their smart use of financial data for identity and income verification, as well as repayments—important pillars of lending operations. Under the hood, Financeit leverages Flinks’ data connectivity to collect financial information, and relies on Attributes to help with the data processing. As a result, they’ve been able to improve and automate their income verification process—all while providing a smooth and convenient experience to borrowers.

Building the insights-driven lending tech stack

The business of lending requires effective and efficient credit decisioning, especially when issuing sizeable loans.

To get a better understanding of their borrowers’ ability to repay their loans, a growing number of lenders go beyond traditional credit scores to look into income and affordability as well. Verifying income, however, is typically a cumbersome process that requires analysts to manually comb through bank statements and pay stubs.

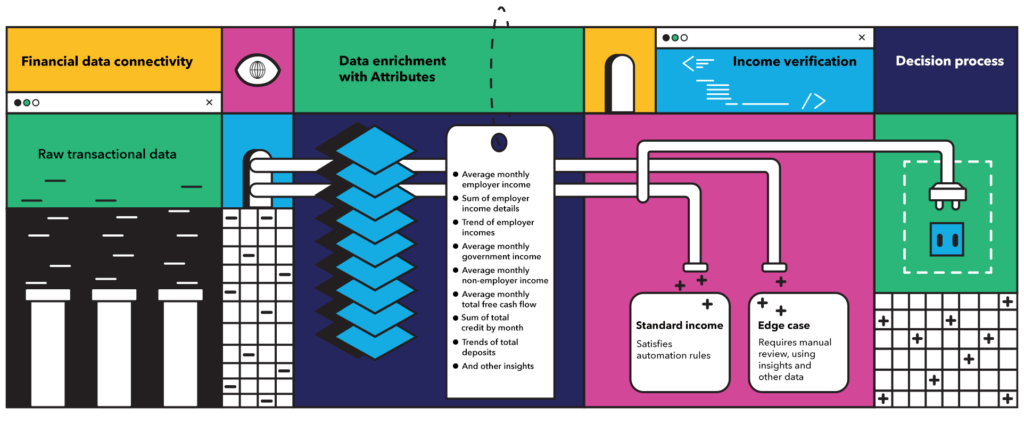

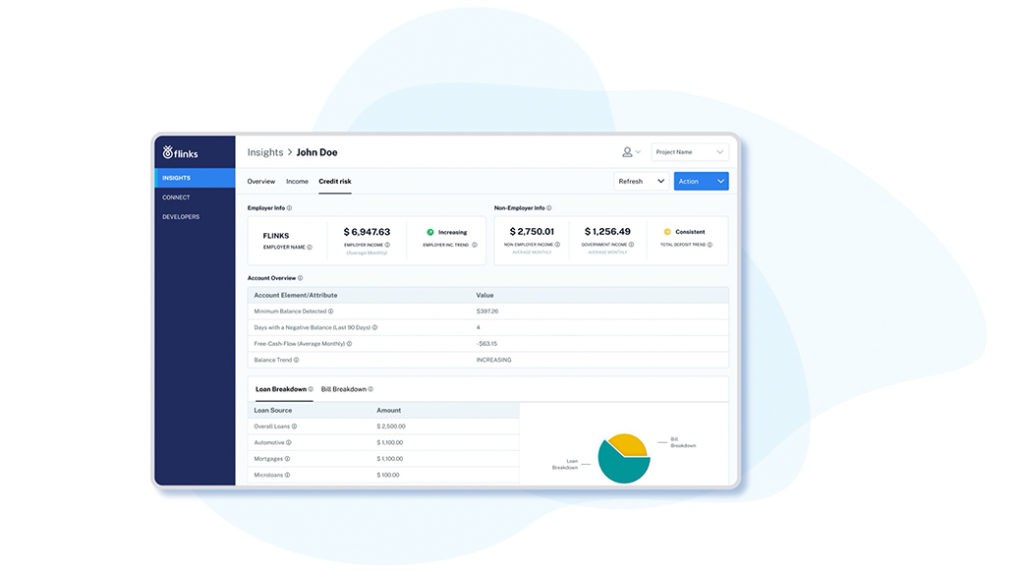

Financeit uses Flinks’ data enrichment product Attributes to help run its income verification processes more efficiently.

Attributes automatically processes transactional data and outputs a series of model-ready insights: income streams, frequency of deposits, cash flow trends, and more.

“To be a responsible lender, we want to make sure that we’re only providing financing when we’re confident that borrowers can actually afford it. Flinks is one of the tools we use to make responsible choices.”

Financeit’s decisioning process leverages insights from Attributes in two ways:

- Automating income detection. Financeit uses rules for what they consider as a standard income, and applications that satisfy those rules can go directly to decisioning.

- Enhancing manual review. When edge cases happen and manual reviews are required, Financeit’s analysts can use insights from Attributes as part of their work.

Applying is as simple as it gets

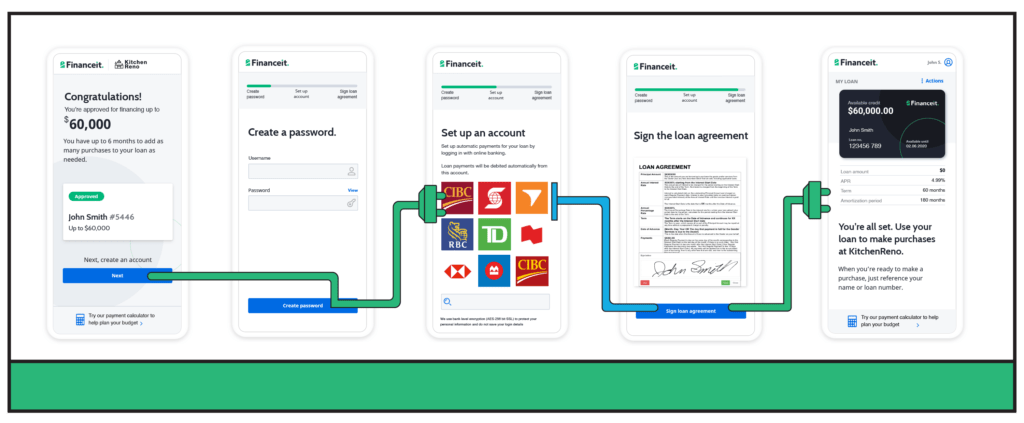

On the front-end, Financeit embeds Flinks into the loan application experience as a quick and convenient way for borrowers to share their financial information.

In a single step for borrowers—connecting their financial accounts with Flinks to authorize a transfer of information—Financeit can access account-level and transactional data to plug into their sophisticated decisioning engines.

“You can’t get anything that has higher friction in a user experience than asking for someone’s pay stub up or bank statement. That’s the worst thing you can ever do. That’s the part where Flinks comes in to help out our merchants run their business smoothly and build trust.”

- Identity verification. Financeit receives bank-sourced customer information (full name, address, and contact information) and is able to use it as part of their identity verification process.

- Transactional data. Flinks enables Financeit to collect transaction data. The data is automatically processed by Attributes, which outputs the insights Financeit uses as part of their income verification process.

- Recurring payments. Financeit uses Flinks to verify borrowers’ financial accounts (account, transit, and institution numbers) in order to set up recurring payments quickly and efficiently—eliminating the need for void checks or pre-authorized debit forms.

If you build it right, they will embed it

Financeit’s partnerships with thousands of merchants as well as major retailers point to the future of embedded finance: multiple financial and non-financial businesses coming together to offer excellent, cohesive customer experiences.

The frictionless experience that Financeit has with the help of Flinks’ data connectivity and enrichment replaces a whole series of steps that a customer would have had to do with their financial institutions separately before signing an agreement or making a big-ticket purchase.

In doing so, Financeit helps everyone move forward with what really matters: getting started with home improvement projects. If, like our client Financeit, you would like to build your product on Flinks’ data layer, talk with our experts. We enable lenders of all sizes to serve their customers better with data connectivity and enrichment.

You might also like

Optimize your loan underwriting with Flinks IBV & Analytics platforms. With coverage on over 10,000 financial institutions in the US & Canada, Flinks helps you approve more loans, faster.

Attributes: Financial Data Enrichment

Businesses collect data faster than they can make sense of it. Attributes’ unique data enrichment and analytics engine delivers actionable, model-ready insights each time customers connect their accounts.