Yves is Flinks' Content Strategist. He tells the world about the dramatic changes happening in finance, one story at a time.

How Flinks Helps Merchant Growth Deliver Convenience in SMB Lending

This is the story of trailblazers that have discovered a new way to support small and medium businesses through data-powered financing. Merchant Growth is a leading SMB lender in Canada and what sets them apart is how well they deliver on their differentiators: quick, easy, convenient.

Running a small business is a demanding and challenging job, especially since the pandemic. SMB owners need financing to keep their doors open and expand their business. Many of them lack easy access to capital and struggle with credit.

On the lender’s side of the coin, there isn’t a simple one-size-fits-all formula for assessing credit risk, and understanding cash flow, revenue, and expenses of a retailer or restaurant’s finances versus an e-commerce site’s, for example.

“Everything we do drives convenience for our customers. Bank transaction data is a key pillar in our risk score analysis—and we need to keep our loss rate low. Flinks allows us to digitize and automate our processes for faster, better service and targeted product offerings.”

— David Gens, CEO, Merchant Growth

How does Merchant Growth expedite the onboarding process, assess risk, and approve funds to its customers in just 24 hours? What does the future of data-powered lending hold for the product lines they develop and offer? Read on to find out.

Objective

- Merchant Growth’s mission is to be the most convenient source of finance and capital for Canadian small businesses

Approach

- Provide a fully digital, quick, and easy experience for customers

- Automate the onboarding process and risk analysis

- Use transactional data in the underwriting process to target product lines to customers and assess risk

Benefits

- One step onboarding process for users, enabling Merchant Growth to access historical and real-time transactional data instantly

- Automating the initial underwriting process and risk analysis

- Better risk assessment, keeping loss rate low

Save this case study for later. Download as a pdf.

Trailblazing a new way forward for SMB lenders

The financial services industry is a competitive space. Making financing quick, easy, and convenient is a key differentiator for many lenders, especially in the alternative SMB space. Small business owners need convenient financing options that allow them to prove their creditworthiness fast. In other words, convenience serves the higher purpose in removing obstacles for both Merchant Growth and its SMB customers.

“In a service business where the product you’re selling is money, your delivery is everything. How well you treat your customers and how convenient the entire experience is from onboarding to delivering on a relevant product—it’s a real differentiator and where we focus on being best in class.”

For Merchant Growth, Flinks’ data connectivity is key to helping them run their business smoothly—and follow through on their mission and differentiators. Just as Flinks is in the business of empowering Merchant Growth to deliver convenience, Merchant Growth is in the business of fuelling (and financing) the growth of small businesses.

When Merchant Growth’s customers choose to submit information directly from their bank with Flinks, they can receive funds in as fast as 24h.

Using Flinks, borrowers submit their information in one single step instead of having to gather and share paper statements.

Providing a fully digital, quick, and easy experience to SMB customers

Merchant Growth embedded Flinks’ data connectivity into their loan application flow, powering a more convenient one-step onboarding process for users.

Data connectivity means that the user doesn’t have to leave Merchant Growth’s application flow in order to source and share various bank statements and manually fill out forms. Instead, their accounts are connected instantly. The lender is granted access to bank-sourced, organized, usable, and secure financial data automatically.

“We use Flinks every time we underwrite loans, which includes every time we renew the customer. We instantly pull financial information as a part of the application process and now we get constant data to make better decisions faster.”

Assessing risk with real-time transactional data

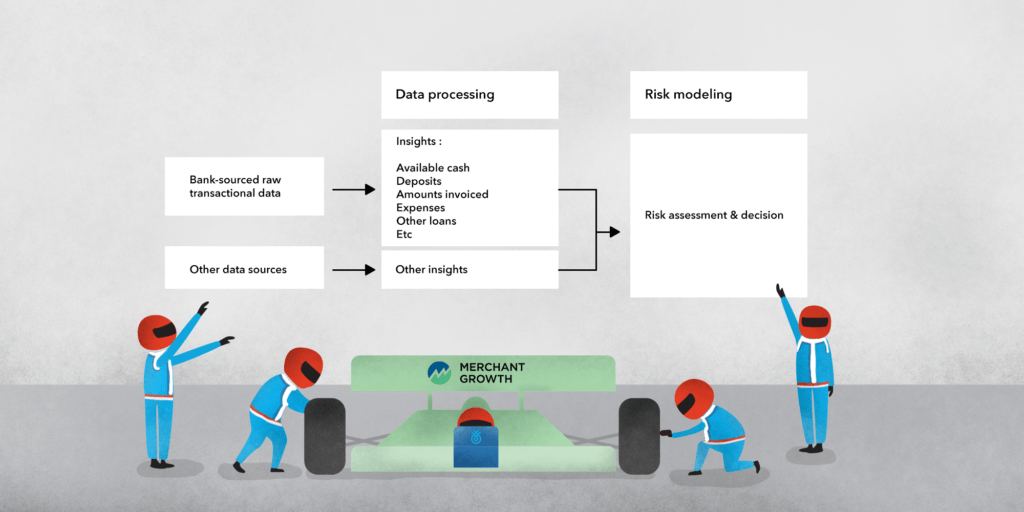

There are many reasons why money flows in and out of business accounts, including variable and fixed expenses and revenue. Using and making sense of the raw transactional data isn’t as straightforward as a credit score, but once unpacked, the insights within may offer a clearer and more holistic financial picture into SMBs.

Merchant Growth uses transactional data pulled automatically from SMBs’ bank accounts as the foundation of their risk assessment models.

Merchant Growth processes the raw data themselves and extracts data points and variables necessary to power their risk assessment models—and decide whether or not to provide the loan and at what price.

“We’re recreating a cash-based financial statement for the business from bank transaction data, so that we can figure out what the customer can afford, how much financing to offer them, whether or not to say yes, and at what price—banking data is critical for all of this.”

In this way, transactional data provides the raw material necessary to understand their customers’ actual and entire financial situation, however complicated. This deeper, real-time understanding supports the smarter and faster initial underwriting processes—and helps Merchant Growth keep their loss rate low as they take on more customers.

Targeting product lines and developing future services

Data connectivity and their risk assessment models have allowed Merchant Growth to tailor their offerings to customers based on their current, historical, and actual financial situation, business needs, and ability to repay. This is a cornerstone of their product development strategy.

“Put yourself in the shoes of a small business owner. By providing financing quickly and efficiently, we are able to help small business owners execute on their vision and grow their business without taking away from their day to day activities growing their business. This is what’s important.”

— Sean Watkins, Director of Marketing and Revenue Operations, Merchant Growth

Beyond easy onboarding and faster, smarter underwriting with data connectivity, Merchant Growth sees the potential for credit products that fit different needs with time. For example, a customer may be approved for an advanced loan with variable repayment based on sales or daily or weekly fixed payments. They have a revolving line of credit products that a customer may not need financing for now, but they may require it seasonally or as their business grows.

Monitoring a borrower’s finances from a risk perspective has added benefits in helping with market renewals and targeted product lines, customer service, and even developing (and perfecting) future offerings.

You might also like

How Flinks Helps Spring Financial Serve Every Single Customer

Find out how Spring uses Flinks to run a new generation of risk models, tailor offers to the full range of risk profiles, and personalize touch points.

Data Enrichment: The Next Evolution in Data-Powered Financial Services

Flinks pioneers a new generation of data enrichment tools that make it easy for businesses of all sizes to extract insights from their customers’ financial data, and use them to power their use cases.