Flinks gives you the power to build the future of finance. Connect, enrich and utilize financial data to delight your customers with amazing products.

How Jeeves Uses Flinks to Onboard Startups and Fuel Their Growth

To call Jeeves a fast-growing fintech company would be a wild understatement. Jeeves launched in Canada—with the help of Flinks’ data connectivity—and Mexico in Q3 of 2021. By Q2 of 2022, Jeeves had launched its financial solutions in 24 countries including the United States, exceeded $1 billion of growth transaction volume, completed a successful Series C funding at $2.1 billion, and amassed thousands of global and fast-growing startup clients like itself.

Their secret? They’ve found—and filled—a serious need in the market that’s full of startups and fast-growing companies in need of financing. The first hoop to jump through with most major banks and traditional lenders is the ability to show several years of profit and loss statements. Jeeves uses financial data connectivity, machine learning, and AI to become the financial partner that startups need and deserve.

“We’re taking a calculated risk based on new data, AI, and a machine learning model that we’ve built on the back-end with the support of a financial data connectivity partner like Flinks. Flinks provides by far the best open banking integration in Canada—which is a huge market.”

– William Lam, General Manager, North America, Jeeves

Read on to discover how Jeeves uses Flinks to power a new generation of businesses, by streamlining the initial credit underwriting and facilitating access to capital down the road.

Objective

- Provide credit, growth capital, and working capital to an underserved market of companies with novel business models

Approach

- Use AI, ML, data, and Flinks’ data connectivity to understand clients’ financial situation in real-time and be able to provide capital and credit with calculated risk

Benefits

- Streamline the onboarding process with initial credit underwriting supported by real-time financial data

- Simplify access to growth capital and working capital with data-driven credit risk assessments

How Jeeves Streamlines Initial Credit Underwriting With Flinks

Business models have changed drastically over the past decade or two. There is a huge, fast-paced, and fast-growing economy of startups and high-growth companies whose business models simply don’t fit the traditional mold for underwriters.

How many e-commerce companies or startups can provide at least three years of profits and losses in order to qualify for a business loan or corporate credit card?

“We’ve had tremendous help from Flinks. When you think about us getting the P&L statements, financing, and a snapshot of a business owner’s financial situation––having access to that information in real-time and digitally is something that we wouldn’t have dreamed of even a decade ago.”

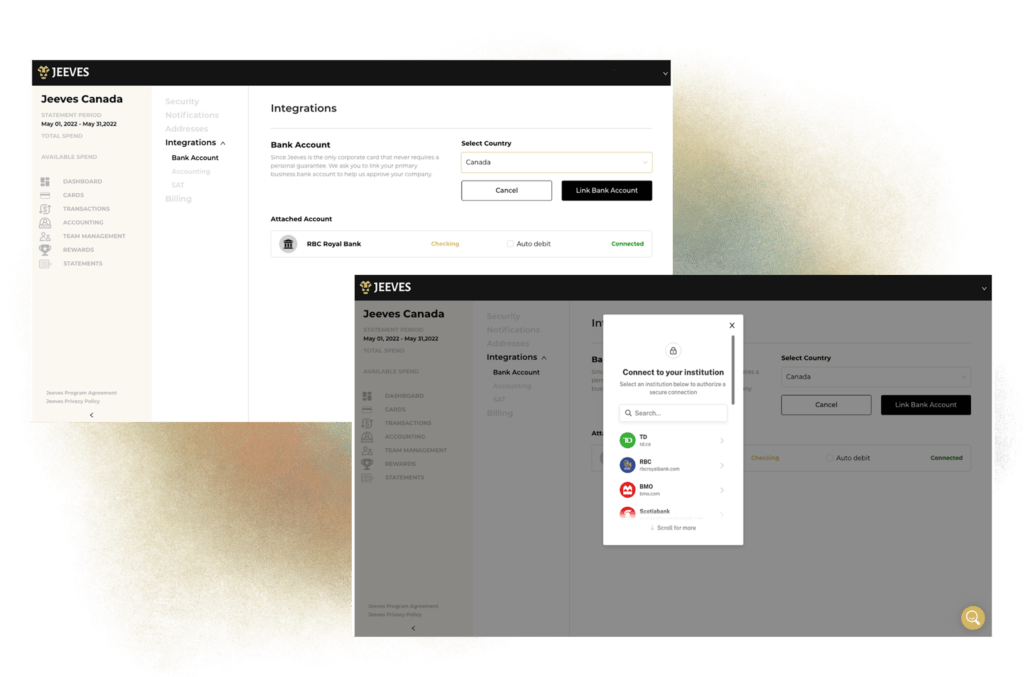

Flinks enables Jeeves in two essential ways (with several added bonuses).The first is through the onboarding process by helping to perform the initial credit underwriting. New clients are asked to connect their financial institutions through Flinks Connectivity during their onboarding process on Jeeves’ credit card program and spend management platform.

As a result, Jeeves receives a snapshot of their financial health and information, on top of any other information provided during the application process.

“Without Flinks, we wouldn’t have the ability nor the data to provide that upfront.”

This financial data filters into Jeeves’ machine learning models in order to provide a credit limit that traditional banks and lenders may not be able to provide without years of financial history and credit.

Credit Risk Monitoring In Real-Time to Provide Growth Capital to Startups

The second important way that Flinks enables Jeeves is by helping them understand and meet their clients’ financial needs as they grow and expand their businesses. Let’s say that a client raises $20 million from a venture capital firm. Most lenders would need their client to send them the past three months of statements, explain why the money’s coming in, where it’s from, fill out some forms, and so on.

Flinks provides Jeeves with that information in real-time so that they can verify the event and ensure proper credit risk monitoring systems are in place right away.

“That is so powerful and helps us speed up and streamline the credit risk model while being the financial partner that our clients need us to be as they expand.”

By looking at the financial data throughout the client relationship—not just at the onboarding—Jeeves simplifies access to their growth capital and working capital products. The constant feed of financial data allows Jeeves to provide more value to its customers, see how they’re doing financially, and adjust risks and offerings accordingly.

Financing the Underserved Market of Fast-Growing Companies and Startups

Jeeves was the first to provide a full corporate credit card and expense management platform in Canada––something that Flinks is proud to be a part of. Financial data is, after all, a large part of the backbone of Jeeves’ operation both globally and locally in Canada. Data is critical to their ability to operate and be the partner that startups and fast-growing companies need and deserve.

“We’ve been very fortunate and happy with the partnership with Flinks and are excited to grow together as we innovate underwriting.”

If, like our client Jeeves, you would like to build your product on Flinks Connectivity, talk with our experts.

You might also like

Introducing Flinks Enrichment for Commercial Lending: Business Financing Just Got Better

Introducing Flinks’ Business Analysis report: our core Enrichment engine just expanded beyond consumer financing and into the business space.

Open Banking 101: What It Is, How It Works, and Where to Start

With open banking, access to financial data becomes simple and reliable. Discover how you take advantage of the technology to grow your business.