Two years ago, we introduced Attributes with the vision to make the analysis of financial data easier.

Today, we are thrilled to announce that the next-gen open banking data analytics tool is finally here! Flinks Enrichment is now easier to use and smarter than ever.

You can now deploy Enrichment on top of your current data infrastructure—whether your data pipeline is coming from Flinks or you’re BYOD (bringing-your-own-data) from other open-banking providers. Our high-performance data analytics engine then extracts and visualizes meaningful insights from your financial data, with above 95% accuracy across our most used categories.

Flinks’ new Enrichment also means that you can:

- Have flexible integration options—whether you want to use it as part of our dashboard experience if you are new to data connectivity, or as a standalone data analytics engine on top of your existing aggregated data

- Receive highly accurate reporting—gain an in-depth understanding of your customers with our pre-built and easy-to-read reports, covering the most common financial use cases for your day-to-day operations

- Leverage out-of-the-box digital transformation—maximize the value of your financial data, empower your teams with actionable insights, and fuel your product innovations at scale

Quick links

- What challenges does Enrichment solve?

- Flinks’ solution—Enrichment

- How are some of our clients using Enrichment?

- What’s next?

What challenges does Enrichment solve?

Data is foundational to business intelligence. However, more data isn’t necessarily better. Moreover, many businesses, with or without data science teams, are struggling to make use of the data they already have.

More data ≠ better outcomes for customers. So how can financial service providers use more of the data at their disposal to power their data-driven reinvention?

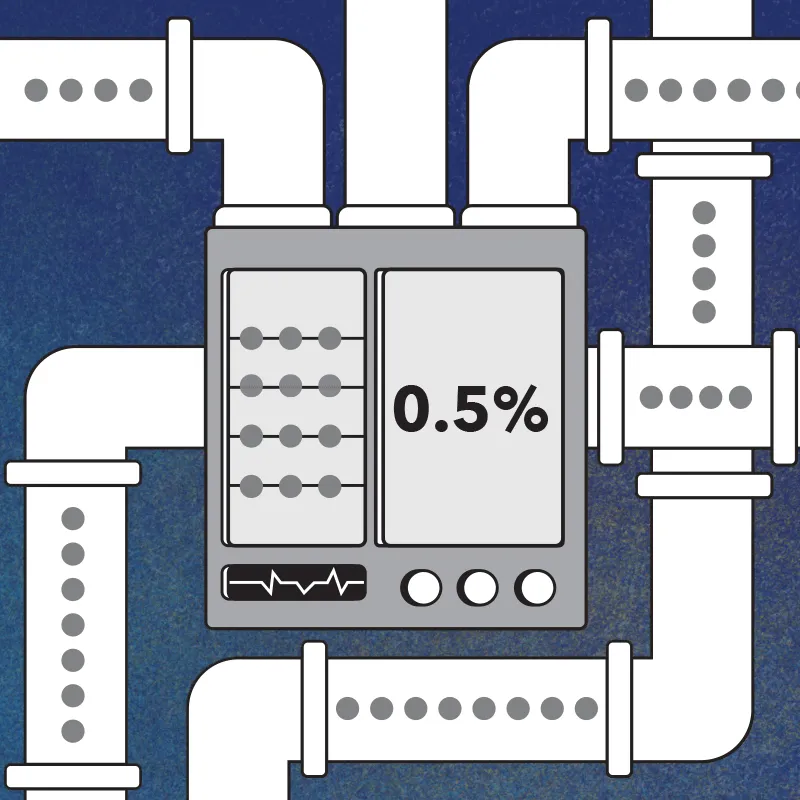

Financial institutions have more data on their customers than anyone else, but use only 0.5% of available data.

(Source: PwC)

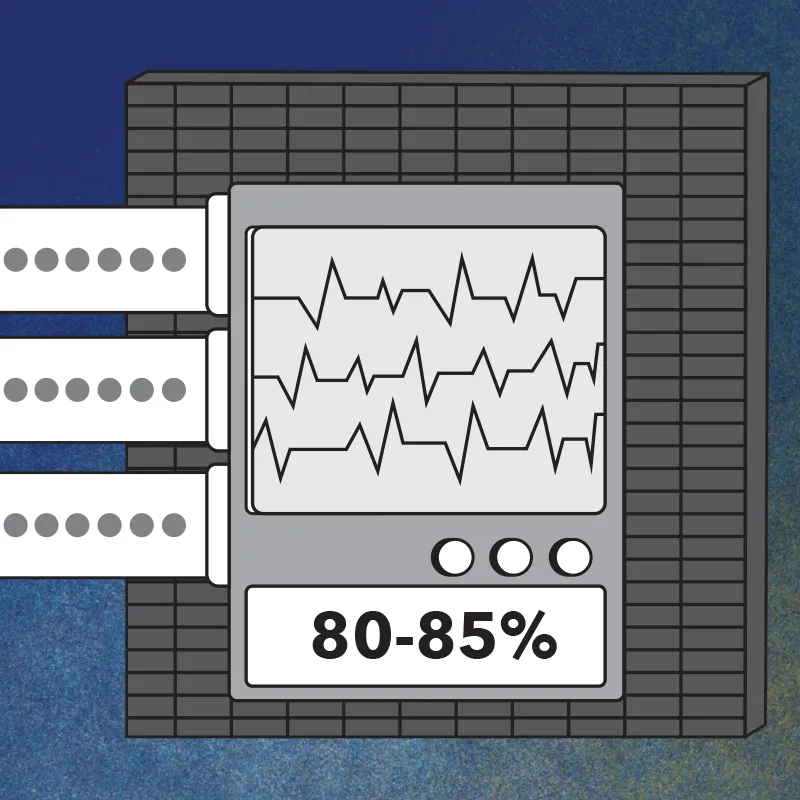

80-85% of financial service providers remain stuck in the “proof-of-concept factory” phase of data maturity.

(Source: Accenture)

While 74% of firms say they want to be “data-driven,” only 29% are actually successful at connecting analytics to action.

(Source: Forrester)

Challenge #1: Not all data is created equal

Businesses nowadays are using a variety of data providers, or gathering data from different financial institutions. The returned data set is often inconsistent, varying in format, timeliness, accuracy, and granularity, affecting its overall reliability.

Our clients using data connectivity services shared that 30-40% of their customers’ transactions were returned with missing labels. As a result, they often had to manually gather the missing information, or make decisions based on a partial understanding of the customer’s financial status.

Challenge #2: Data doesn’t speak for itself

Many companies are sitting on a data goldmine, which doesn't translate into real-time insights to proactively power their decision-making. Data is wasted if companies don’t know how to utilize it.

Yet, mining untapped data isn’t easy—it requires your data science team to process mountains of data to make appropriate modeling assumptions; coming up with one solution and turning it into a product adds another layer of complexity.

Challenge #3: Data insights are not always actionable

As business intelligence allows us to gain a decent amount of insights from our data, not all the takeaways will be actionable or even helpful. Not to mention that many data analytics platforms tend to display an abundance of information—not necessarily insights that can be applied directly to business processes.

Additionally, data insights from a third-party analytics engine are not always closely tied to your key business goals and strategic initiatives; insights generated from an internal data enrichment tool are more likely to drive action, but building one can be costly and resource-heavy.

Flinks’ solution—Enrichment

Enrichment was designed to turn your customers’ raw, unprocessed financial data into visually rich insights that can power your decisioning. By cleansing, organizing, and analyzing data, we deliver meaningful output that is aligned with your business strategy and maximizes your analytics investments.

Enrichment does the heavy lifting for you by expanding your data ecosystem and offering tailored insights, together with driving better business outcomes.

Benefit #1: Build a future-proof data ecosystem

As an industry-leading open finance enabler, Flinks Enrichment doubles down on this position by allowing businesses to build and expand their data ecosystem, combining various datasets—no matter where they come from and regardless of their formats—to inform truly data-driven decisions.

You have two options to use Enrichment as the smart analytics layer on top of your data: 1) through API endpoints for API integration, and 2) through Flinks’ Client Dashboard to directly upload your data. Either way, you don’t need to make changes to your existing data infrastructure; let Enrichment help you expand and build a scalable data ecosystem.

Benefit #2: Transform data into actionable insights

If data is the oil of our time, data enrichment is the refinement process necessary to make it usable for all. Flinks delivers business intelligence in the form of data visualization within reports consolidated in a dashboard, turning raw transactional data into a standardized, consumable format.

The ready-to-use insights allow your tech and non-tech teams to have the ability to conduct fundamental data analytics tasks, such as interpreting ratios, understanding trends, and predicting customer behavior better, which is key for real-time decisions and tailored offerings.

Benefit #3: Scale your excellence in data analytics

Enrichment was trained and built on complex and vast datasets to be more representative when it comes to data analytics. Hence Flinks’ enriched data is more granular and flexible compared to other broad categorization engines in the market.

We run accuracy tests on our clients’ most used models twice every quarter to maintain near-zero miscategorizations, and also constantly feed more data into our engine for better modeling to grow our clients’ data confidence.

You can choose from over 1,800 attributes and customize outputs for your business’s unique use cases. Use Enrichment as your out-of-the-box data science team to enable decisioning, or leverage it to help your data and/or risk teams fine tune modeling and gain analytics proficiency.

How are some of our clients using Enrichment?

A fintech startup offering alternative student loans

Before Enrichment:

- No data science resources, limited data analytics capabilities

- High cost associated with producing enriched data points specific to their risk models

After Enrichment:

- Utilizing pre-built attribute to flag the first paycheck event, signaling the collection of a loan payment

- Expanding their offerings with accurate insights, understanding customer behavior with ongoing monitoring, and building products fast

An established business credit card provider for SMBs

Before Enrichment:

- Using multiple data connectivity providers and collecting various outputs

- Spending resources navigating enriched data and building processes for standardized reporting

After Enrichment:

- Deploying ready-to-use packages on existing data to determine income and liabilities, as well as forecasting free cash flow

- Leveraging the flexibility of enrichment, allowing their data science team to expand and improve their risk models with additional features

“It’s all about understanding our customers—and Flinks provides the best insight into consumer behavior that exists.”

— Tyler Thielmann, VP of Consumer Lending, Spring Financial

Discover how Spring Financial used Enrichment to serve every single customer.

> Read the case study

What’s next?

In the next couple of months, Flinks will continue strengthening the Enrichment offering by adding functionalities and improving usabilities, such as support for additional data formats, customization around reporting and templates, and business attributes.

Enrichment is applicable across many use cases, and we are only scratching the surface of what’s possible once you can access and make use of financial data. Ultimately, we want Enrichment to do the heavy lifting for you, so that you can focus on building forward-looking products and services that your customers will love.

Talk to our experts to learn more about how Enrichment can work for you.