OAuth is a technology that enables Flinks end users to connect their bank accounts to a chosen fintech without sharing credentials. It’s the safest and easiest way to do so. By using OAuth to power your end user flows, you can create user experiences that customers love. It’s an integral part of our Open Banking ecosystem.

In our previous blog, we spoke about Open APIs, OAuth, and Open Banking, explaining what they are and how they’re connected. But what type of performance can you expect from OAuth and Open APIs? What measures are in place to ensure a better experience than screen scraping? And what problems does it solve?

Read on to learn about:

- Creating A Frictionless Process For End Users

- Reducing Repetitive Tasks And Errors

- Putting Consumers In Charge Of Their Data

- Getting The Most Out Of Flinks

- Open Banking Standards

Creating A Frictionless Process For End Users

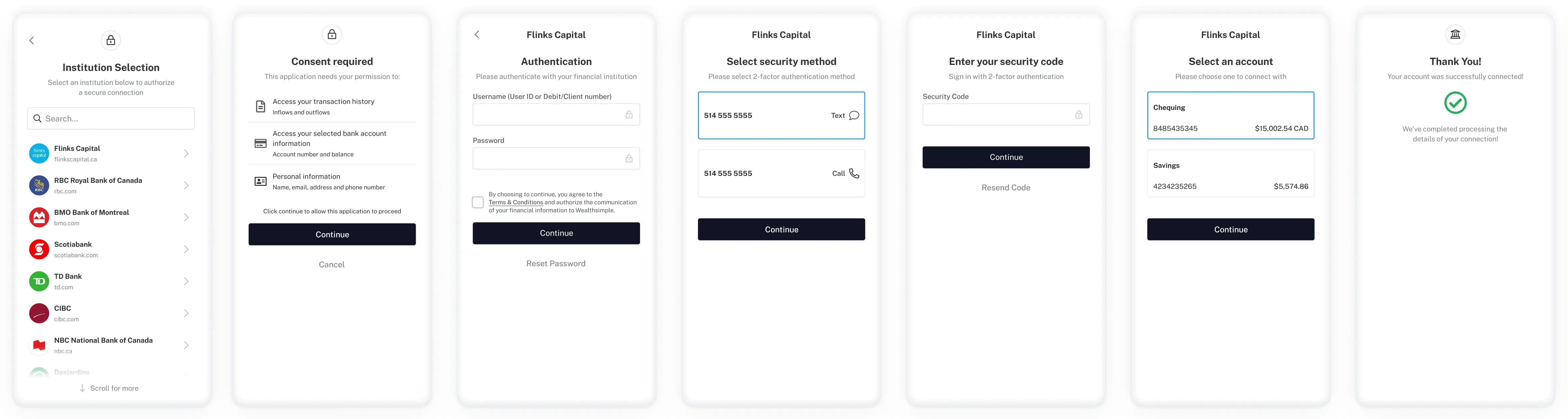

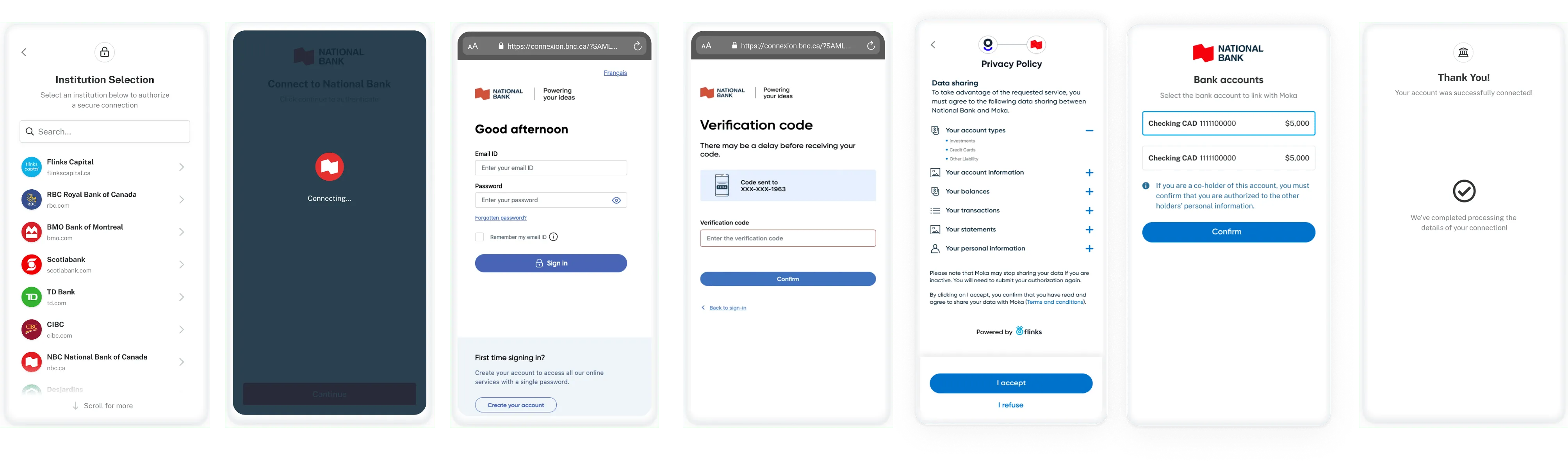

OAuth is the central piece of Open Banking technology that allows end users to connect their bank accounts with third-party apps. OAuth is different from screen scraping in that it never handles a user's credentials. In fact, it eliminates credential sharing as end users will authorize information sharing from their bank directly.

As part of your authentication/onboarding flow, end users are directed to their bank before returning. When they’ve arrived at their bank's page, they’ll sign in and consent to share the data within your scope. After authorizing the data, they’ll then be brought back to complete the remainder of your flow. Once authorization is given, only the end users can revoke consent. They can revoke through the bank account they have connected at any time.

Since the data comes directly from the bank, connections take seconds (not minutes). Errors and delays that normally persist are removed—more on this in the next section. Eliminating screen scraping also improves user trust, as they have an existing relationship with their bank. This builds further credibility for your products and services. And the speed of the connection reduces the chances of end users dropping out of your onboarding flow.

All of this combined greatly improves conversion rates.

With dozens of Open Banking APIs, OAuth currently powers 50% of end user connections for Flinks in the United States alone. As more banking connections are added, they’ll become available to you and your end users. This ensures your end user flow improvements at scale. By switching to OAuth, you’ll improve user experience on available connections.

Reducing Repetitive Tasks And Errors

The data that comes from Flinks OAuth is more accurate, with 100% of the available bank data being captured. Information such as account and routing numbers are consistently pulled, and reported income stays accurate. This reliable data allows you to provide a better–and more consistent—experience. Since regular sign-ins are no longer required, data can be refreshed at any moment once consent is provided and maintained. This means point-in-time accuracy for all of your data-backed decisions.

OAuth and Open Banking APIs greatly reduce the need for human review and intervention. With more accurate data available all the time that can be updated in an instant, our use cases are even stronger. These include personal and commercial lending, compliance, PFM (personal financial management), multi-banking, accounting, and more.

Experience further automation and increased accuracy using Flinks. Read more about our financial institution and fintech solutions.

OAuth eliminates errors associated with login attempts, including:

- Multi-factor authentication

- One time passwords

- Password changes

- Platform changes

How? Login errors are reduced through a server-to-server connection between APIs. The server connection creates a token to identify the user in place of their credentials. The token then serves as a handshake between third-party apps and the financial institution.

Putting Consumers In Charge of Their Data

Whether we’re talking about Open Banking, Open Finance, or the larger Open Data movement, it comes down to putting consumers in charge of their data. Consumers should be enabled to use the products and services that they choose. This data should be available to them whenever they want, and their experience of accessing and sharing their data should be safe and seamless.

A key element of using Flinks OAuth and Open Banking APIs is that it’s the consumer that owns and controls their data. Once they authorize an application to use their data, this authorization can only be removed in two ways:

1. The end user revokes consent, or

2. The consent reaches the expiry period set by their financial institution.

Since users rarely have to re-authorize, applications will have sustained connectivity to data. This results in fewer data requests to end users, as well as increased data visibility and security for all.

Delegate Authority With OAuth

OAuth also enables you to delegate authority, meaning third-party apps make an automated request to the end user for consent to access secure information for a set amount of time. Since end users view Flinks’ consent screen and provide user-permissioned data through their bank, connecting to a financial application is a reliable experience.

The consent given is read only, removing the possibility of fraud. Flinks OAuth provides consumers with the tools and information they need, while empowering them with the ability to choose who can access their data for how long. This translates into improved trust for your processes and your business, plus increased conversions.

Getting The Most Out Of Flinks

Migrating to Flinks OAuth means access to a direct green-lit server of a dozen—and counting—Open Banking APIs, which ensures consistent data retrieval, decreases latency, and improves uptime. Plus it's faster, so users are less likely to drop off. As a result, more users will opt to use Flinks OAuth to connect, with a higher success rate and speed of completion.

Flinks’ clients can also enable Flinks Event Listener to receive real-time notifications of pending or unsuccessful connections. You’ll be able to have a live look at how your customers interact with your authentication and onboarding flow. Using Flinks Event Listener allows you to provide real-time prompts to end users, reduce friction and drop offs within Flinks Connect, and ultimately convert more users to your products and services.

Partnering with Flinks for your Connectivity needs also means you’ll have a sales rep, relationship manager, and technical account manager. Your Flinks team acts as an extension of your business to ensure you get the most out of OAuth. We’ll work proactively to make sure that our technology and your workflows are working for you and your customers.

Open Banking Standards

Whether you’re a fintech or a financial institution, OAuth is the fastest and safest technology to connect users. By relying on Flinks OAuth and financial APIs, you’ll be set for the removal of screen scraping. As your financial data partner, Flinks takes on the responsibility to meet whatever Open Banking standards are set. As things change and evolve, Flinks will ensure you remain compliant and can continue to provide a superior experience for your customers.

Looking to take your customer experience to the next level?