Flinks gives you the power to build the future of finance. Connect, enrich and utilize financial data to delight your customers with amazing products.

Flinks Enters the Instant Payment Market with Flinks Pay

Real-time, instant payments for businesses are not currently available widely in the Canadian market. Many businesses are looking for solutions to help them reduce their payment risk and ultimately lower the cost of processing payments.

As part of our commitment to ensure Canadians have access to better financial products, Flinks is looking to change this, making instant payments accessible to any company by embedding them directly into their products and services.

In Canada, thousands of businesses are faced with three major challenges when it comes to payments:

High Cost

Traditional payment methods such as EFT or credit card are costly for businesses

Time to Fund

On average, it takes between 3-5 business days to move money between accounts

Potential Drop-offs

Up to 30% of end-users drop off due to complexity and/or time to fund

To tackle all three of these challenges directly, Flinks is proud to announce that we’re rolling out a brand-new payment offering that we believe is going to be a game-changer in the Canadian market.

What Flinks is bringing to the market:

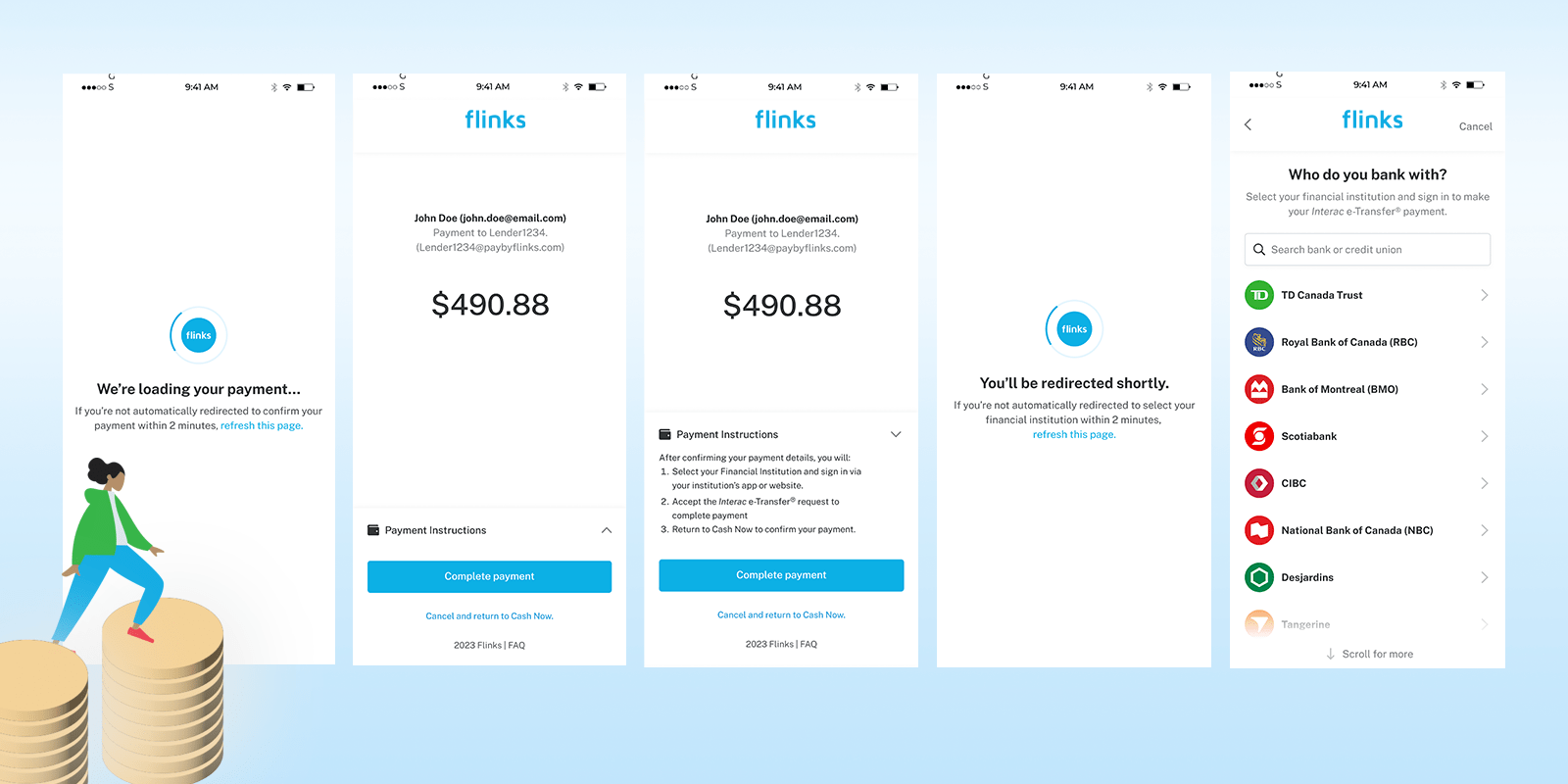

For your end-users, Flinks Pay delivers a frictionless, simple, and fast payment solution to pay for anything directly from their bank accounts at the click of a button. For businesses, Flinks Pay removes hassles by allowing them to instantly, affordably, and reliably receive payments from their customers.

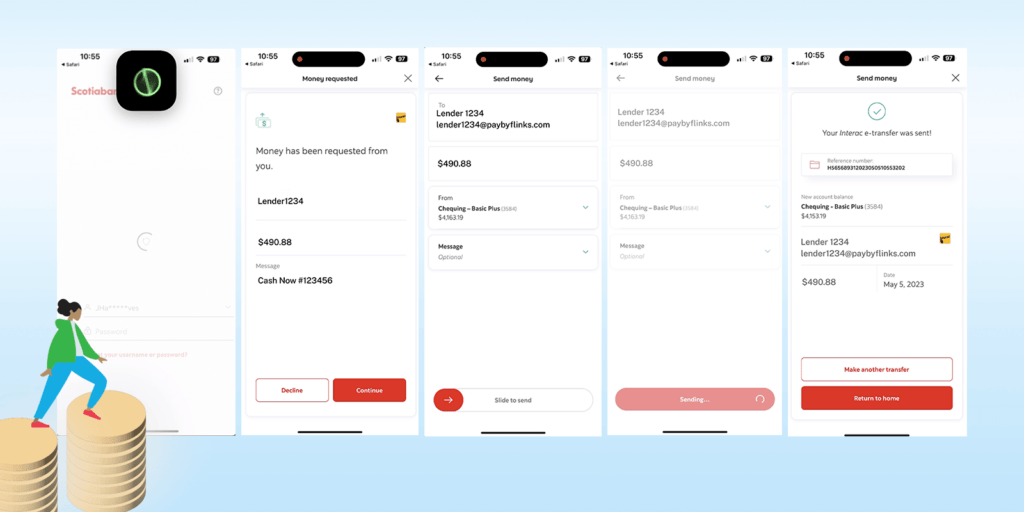

Flinks Pay’s UI enables your customers to easily accept e-transfer requests and make payments directly from their devices, as well as provides businesses with the infrastructure to initiate payments and settle funds.

Additionally, businesses can initiate payment requests, monitor their real-time status, and receive daily reconciliation reports directly from Flinks Client Dashboard or API.

What’s next

This is all about collaboration, taking your input and feedback to build solutions tailored exactly to your needs. We started with solving for bank connectivity, moved into helping our clients with data analysis and enrichment, and are now ready to start delivering on payments.

Flinks Pay is now in beta but set to scale into more payment offerings once it’s fully released in early 2024. Here is a sneak peek of some of the features in our roadmap, slated to be available in the next few months:

- Standard EFT Payments

- Recurring/Scheduled Payments

- Credit Card Payments

- Real-Time Guaranteed EFT Payments

As always, reach out and let us know what payment challenges Flinks can solve for your business and we’ll start building it with you.

Ready to try Flinks Pay?

If you’d like to be among the first to try our new offering and build the best instant payment solution in Canada, join our waitlist now.

You might also like

Payments in Canada – Everything You Need to Know

Get an in-depth understanding of payment methods in Canada, with key insights on the state and future of payments for Canadian businesses.

The Ultimate Guide to Embedded Finance—And How Flinks Enables It

This guide will provide you with a deeper understanding of what embedded finance is, how it works, and the myriad of ways it benefits both businesses and consumers. Let’s dive in!