.avif)

Convert more borrowers while reducing risk

Accelerate loan approvals, gain financial insights to power underwriting, reduce fraud and default risks, and streamline repayment management with Flinks’ embedded finance platform.

Talk to an expert

Trusted by leading financial institutions and innovators

How Flinks can help

CONSUMER LENDING

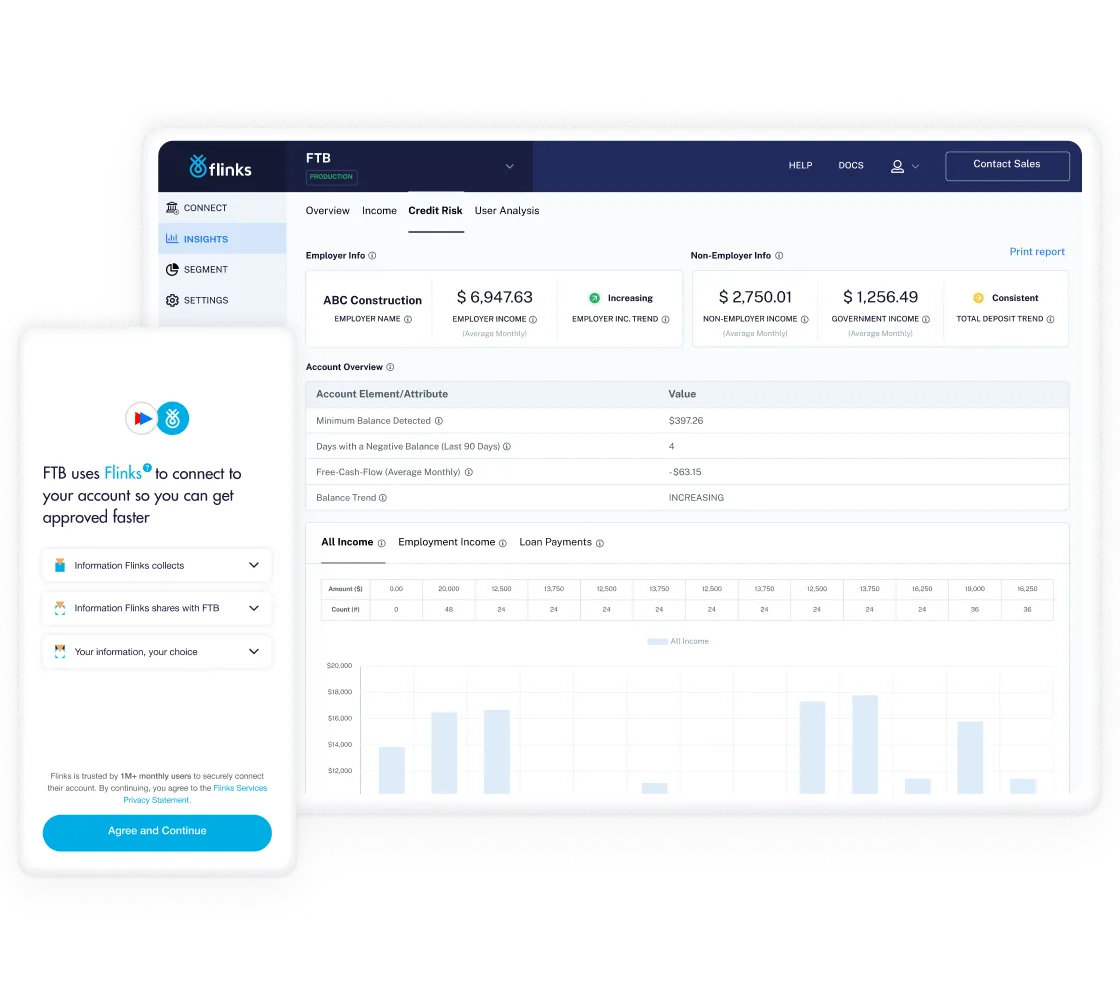

Smarter decisioning and automation

We help consumer lenders streamline every stage of the borrower journey. Connect accounts instantly, access enriched income and cash-flow insights to validate stability, automate document processing with AI-powered fraud detection, and support fast loan disbursement and repayment setup.

Explore Consumer Lending

.webp)

BUSINESS LENDING

Increase velocity and reduce risk on complex applications

Flinks brings speed, consistency, and compliance to business lending. Access financial insights such as operating income, merchant deposits, vendor payments, payroll, cash flow trends, loan payments, liabilities, expenses, and potential loan stacking to assess risk with confidence.

Explore Business Lending

.webp)

We provide 4,500+ attributes to power smarter decisioning

Explore the different attributes that we offer.

Employer income

Pension income

Non-employer income

Transaction breakdown

Government income

Average and total

Child support income

Trend and frequency

Social assistance income

And more

Minimum balance

Loan payments

Days with negative balance

Utility payments

Employer income

NSF fees

Total deposits

Average monthly expenses

Monthly free cash flow

And more

Income attributes

Account age

Credit risk attributes

Purchasing trend

Employer income

Trend and frequency

Loan deposits

Average and total

NSF fees

And more

Income attributes

Recurring payments

Credit risk attributes

Debit activity trend

Average monthly payments

Credit activity trend

NSF fees

Average montly expenses

Monthly free cash flow

And more

Average monthly

Rent deposits

Average deposit

Trend

Last two deposit dates

Frequency

Sum per calendar month

Total detected

Insurance deposits

And more

With our AI and credit models the more data we have, the better decisions we can make. And Flinks help us by giving us more data. They give us both a macro and micro view of consumer behaviour.

Jonathan Goler

Chief Risk Officer

Read case study

Meet with an expert today

Book a 15-minute chat to see how Flinks can help you build seamless

financial experiences.

financial experiences.

Discover how you can:

Onboard and verify clients in seconds

Power smarter decisioning with 4,500+ financial attributes

Get instant access to data from 15,000+ institutions

Authenticate documents and detect fraud automatically

Send and receive payments through one unified platform

Trusted by innovators like

%201.png)

%201.png)