Although our financial system has proven to be resilient the past few years, 2022 has been a different story. With increased interest rates, inflationary pressures, and layoffs in tech, the macroeconomic environment becomes more turbulent, and many believe a looming recession is at the doorstep.

In the consumer lending space, credit cards and personal loans reached a record high of $688 billion in Q3 2022. On the small business side, lending activities dropped significantly, with an index sitting at a low of 100.6 alongside rising delinquencies and defaults. Consumer spending is experiencing a downward shift, and so are the profit margins for small businesses, creating a volatile market for both B2C and B2B lenders.

While tightening underwriting standards to hedge against the upcoming headwinds, lenders are also faced with an opportunity to turn underwriting worries into a competitive edge.

How to confidently open the doors for the higher-risk underserved segments, and provide truly inclusive lending decisions to potentially good borrowers?

Cash flow analysis, with a more dynamic view of an applicant’s point-in-time financial health, can be the key to future-proof credit underwriting.

Context: Cash flow data in consumer and commercial lending

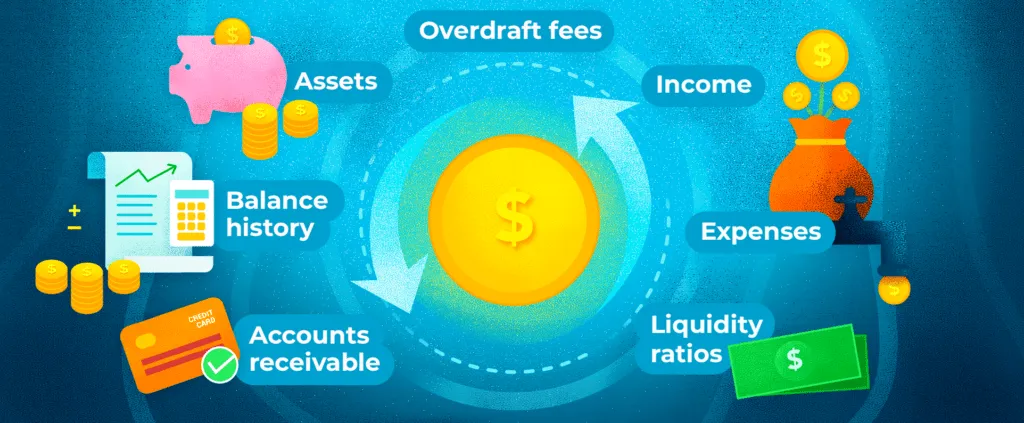

Given that traditional credit scores and/or credit bureau data only reflect borrowers’ credit history, cash flow data appears to be one of the most promising alternative data sources to strengthen existing underwriting models. By deriving directly from applicants’ income and liabilities/expenses, with the indication of balance and frequency, cash flow data uncovers the velocity of funds coming in and going out.

Through data aggregation, lenders can obtain cash flow data directly from borrowers’ bank accounts and conduct cash flow analysis to quickly gauge borrowers’ ability to repay. This is especially true for the subprime and near-prime segments who have been traditionally excluded from mainstream credit.

In this context, cash flow-based lending is becoming the new norm, providing the most lift for lenders to accurately determine borrower creditworthiness.

Simply put, cash flow data benefits both borrowers and lenders, and is the game-changer for lenders to underwrite in volatile times. Here’s how cash flow analysis levels the playing field for all and why you should care.

1. Increase profitability by expanding access to credit

Challenges

Today’s digital lending oftentimes still requires manual intervention when it comes to income verification due to missing or mislabeled data. It is not uncommon for underwriters to review additional documents from different sources to capture all the income streams of a borrower. For instance, gig economy workers who don’t always get regular paychecks or pay stubs might submit tax returns and various bank statements as proof of income when accessing loans.

Liability, on the other hand, is just as important as payroll data. Lenders need to quickly grasp all standard loan payments like mortgages, auto loans, student loans, and more importantly, micro-loans such as BNPL (Buy Now, Pay Later) loans with 69% of subprime or near-prime customers, which won’t necessarily appear on a credit report but remain a center of interest for lenders.

Solution

Cash flow data has the most direct correlation with how personal and/or business finances are managed over time. In turn, cash flow analysis—a snapshot consisting of both income and liability breakdowns—provides lenders with positive monthly cash flow of borrowers and helps accurately predict their ability to repay at a given time.

By looking at a detailed picture of borrowers’ full financial situation in real-time instead of relying on traditional credit history with limited or outdated information, lenders can expand credit availability by serving thin/no credit file borrowers and small businesses without enough credit history.

With cash flow analysis, lenders are better equipped to say yes to more potentially good borrowers even if they don’t have a prime credit score.

2. Strengthen fraud prevention and risk prediction

Challenges

At a time of financial stress and four-decade-high inflation, fraud rates are expected to spike. Whether through first-party fraud with applicants falsifying their bank statements around their income and employment data, or third-party fraud with synthetic identities scamming loans and lines of credit, rates will rise. It is mission-critical for lenders to identify and flag any fraudulent activities upfront in their credit decisioning.

When it comes to underwriting first-time borrowers, it is even more challenging. Underwriters must look closely into consistent debit/credit activities to determine if it’s a primary or fraudulent account. They must also be on the lookout for how many other outstanding micro-loans are there—a payday loan deposit can look like an income in the transaction history, but in reality is just a liability that the applicant needs to pay off.

Solution

Cash flow-based lending is powerful because it offers a combination of insights lenders need within income, fraud, and credit risk in one place. Through historical cash flow data, lenders are capable of understanding the consistency and pattern, flagging any changes or gaps in borrowers’ cash flow month over month for better risk assessment and fraud prevention.

Additionally, it uncovers predictive insights based on the overall trend of income, helping lenders predict borrowers’ likelihood of default in the foreseeable future. For example, based on borrowers' current cash flow, lenders can forecast their cash flow for the next 30, 60, and 90 days, which informs their repayment capacity.

Cash flow analysis is predictive on its own, and even more actionable when combined with traditional credit scores or used in other credit risk models.

Flinks offers consumer and commercial lenders pre-built lending packages as your out-of-the-box cash flow analytics & automated underwriting tool.

From income and liability breakdowns to credit risk analysis, we pull transaction data from borrowers’ bank accounts, add behavioral insights, and make it actionable for your underwriters, loan officers, and risk analysts.

👉Talk to one of our experts today and let us help you conduct credit underwriting up to 30% faster.

3. Improve lender efficiency and end-user convenience

Challenges

In the subprime space where the speed of loan approval and servicing is crucial to remaining competitive, lenders are challenged to find the scale-up recipe to lower CAC (customer acquisition costs) while securing existing customers. Particularly in the low-automation business financing space where underwriting has been historically lengthy and paper-heavy.

Solution

Considering the higher risk profile of borrowers for subprime lenders, cash flow analysis is beneficial to increase lenders’ ability to effectively manage credit risk and lower operational costs over time. From an SMB financing standpoint, cash flow data can be a huge boost that allows lenders to evaluate and pre-qualify SMB loans in a matter of hours versus weeks.

The use of cash flow data drives faster loan origination and delivers a better user experience, ultimately helping borrowers gain easier access to credit.

Conclusion

Cash flow-based lending is helping lenders navigate the unstable waters we're currently facing. Lending requires greater diligence and inclusion than ever, making it imperative for financial service providers of all kinds to leverage cash flow data and its real-time insights for more robust business models.

By using cash flow analysis to guide strategies and decisions, lenders can turn their current underwriting challenge into an opportunity to bring more value to borrowers and restore their financial health. All of this translates into product innovation, customer loyalty, and a better experience for everyone.