The Flinks Blog

Your central hub for news, stories, and insights to transform your business.

Explore blog posts

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Podcast

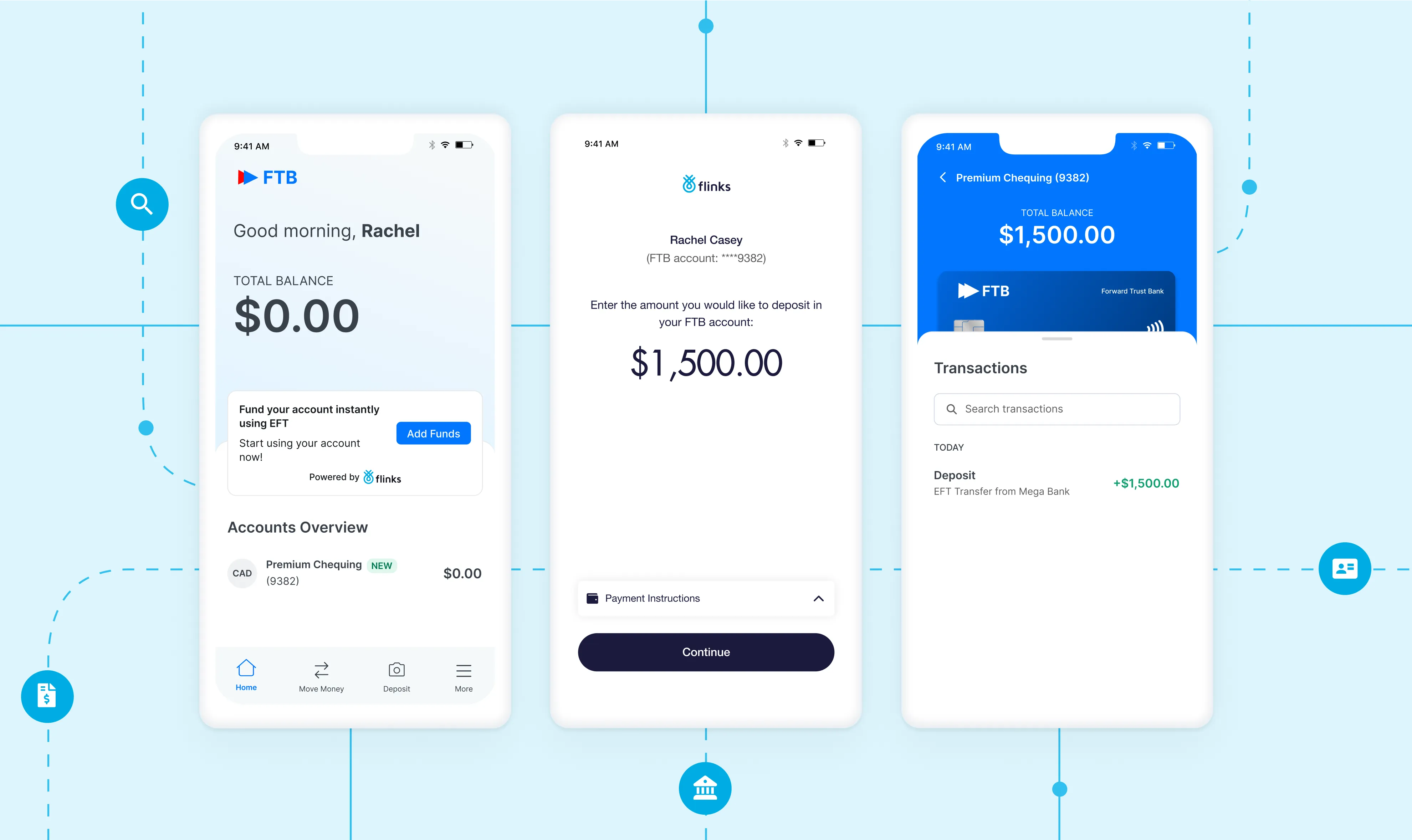

Flinks

Fintech & News

Business Announcements

Insider

User Experience

Open Banking

Product Releases

Digital Transformation

AI & Finance