Annahita is a content and brand marketer who enjoys writing about the transformative power of Flinks and the fintech space. When not telling Flinks' story, you can catch her reading, travelling, and fostering kittens

Getting the Most Out of Your Financial Data – Broad Categorization vs Data Enrichment

The financial industry has long understood the value of data and its game-changing potential. The challenge many companies are facing, however, is figuring out the best way to extract actionable intelligence from the raw financial data they are collecting. This is where broad categorization and data enrichment have the greatest impact.

Raw data is full of untapped potential. That’s because raw data is simply data that has been collected from a source but still remains, for example, as raw data in JSON form, or in some form of visualization, like a table. Broad categorization does a great job of organizing the data for specific use cases, but it’s data enrichment that taps into that potential and turns raw data into valuable insights.

In this article, we’ll provide definitions for both broad categorization and data enrichment, explain the importance of data enrichment and insights, and conclude with five important takeaways on the benefits of data enrichment.

Defining Broad Categorization

The aim of broad categorization is to simplify complex banking transaction data sets into manageable and meaningful groups. Financial data categorization, specifically, is the process by which raw financial data is organized into a set of groups or categories according to predefined criteria.

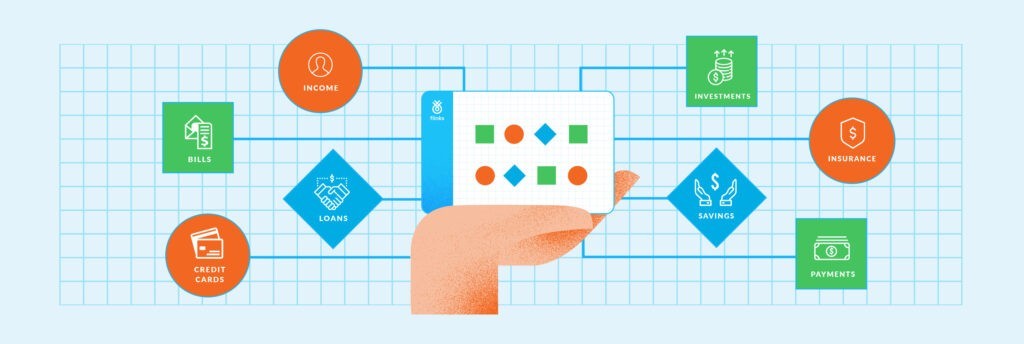

Financial data categorization can include organizing data into categories such as revenue, expenses, assets, liabilities, and more. The categorization can be done for various purposes, including budgeting/personal financial management (PFM) tools, accounting, tax reporting, and performance analysis.

What makes this type of categorization “broad” is the fact that the categories provide a way of organizing and understanding transaction types, but they do not provide any further depth. For example, broad categorization can capture a financial transaction as a deposit from income, but that’s where the information ends. It cannot break down the income source, whether it’s from an employer, government or where it comes from, or how that income has been trending over time.

Some of the higher-level broad categorization APIs can differentiate between a “Grocery” purchase versus “Eating and Drinking,” but unfortunately, that’s where the information ends. Its accuracy rate is also inconsistent, with a significant number of transactions being returned with missing or incorrect labels, leading to many hours lost manually correcting these miscategorizations.

Ultimately broad categorizations are good for providing a quick overview of a user’s financial situation, but it’s not built for decision-making. It lacks the flexibility, granularity, and usability of data enrichment, essentially labeling income and expenses.

Defining Financial Data Enrichment and Insights

Financial data enrichment allows you to filter through the extraneous data and find key behavioral information within the transactions, making raw financial data more useful and accurate. Think of enrichment as a way to dig deeper into the common denominators of your existing raw data and datasets.

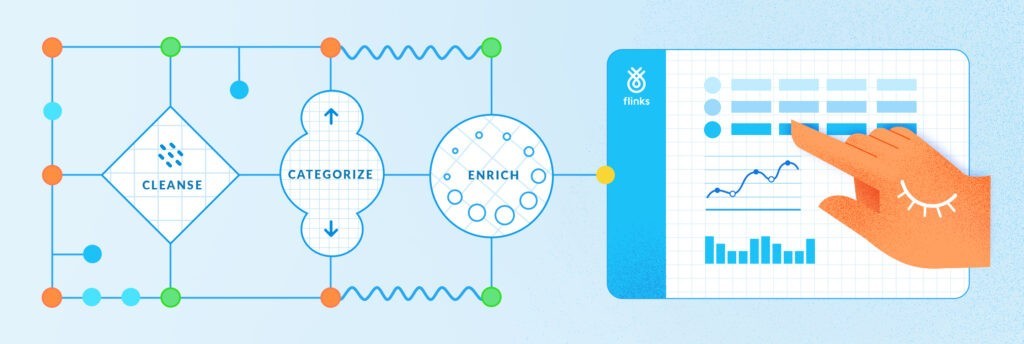

Enrichment ingests raw financial data and then cleans, organizes, and processes it, generating data attributes that are the basis for providing actionable insights. This involves correcting inaccuracies and enhancing the completeness of financial data. Since the data is coming directly from direct API calls or other means such as PDF bank statement uploads, this results in high accuracy labeling and nearly zero miscategorizations.

The major difference between broad categorization and data enrichment is the granular level of detail and insights. Data enrichment is essentially unearthing second and third levels of categorization that are unreachable with broad categorization.

Let’s consider income as an example. In this instance, broad categorization will capture the data point as income, but that’s where it ends. It does not have the ability to differentiate the type or source of the income. Insights tell you the income source, whether it’s from employment, non-employment, government, and so on. It will also tell you how this income is trending over time, for example. This increases the transparency over someone’s finances, for people as well as businesses.

These data-powered insights can be used for various purposes such as customer analysis, risk management, and predictive modeling. Insights are also integral to identifying opportunities for business growth, facilitating informed and low-risk decisioning regarding loans.

Why is Enrichment Important?

Now that we understand the major difference between broad categorization and enrichment, let’s examine why enrichment is so important for the financial industry.

When raw financial data is organized, cleansed and transformed, the resulting outputs are data attributes. These attributes are the enriched data that will feed your models and populate your reports to help you gain a deeper understanding of your clients’ behavior. All without having to deal with the tedium of categorizing, cleaning, or any of the other multitude of time-consuming tasks that arise when working with raw data.

The accuracy of the insights also contribute to the importance of data enrichment. Insights are delivered in real-time and with exceptional categorization accuracy, reducing risk and making it easy to rely on your data-driven decisioning.

Enriched data is also providing you with information that facilitates better customer personalization. Consider enriched data as building blocks you can put together to create a far superior understanding of a business or clients’ financial profile and consumer behavior. The insights provided by data enrichment helps create more complete and dynamic customer profiles through increasing financial transparency and real-time updates.

Shaping raw financial data into actionable information and better insights on customer behaviors is useful for a wide variety of use cases and decision-making scenarios. This includes underwriting, customer onboarding, loan origination, credit risk assessment, KYC (know your client/customer) verification, anti-money laundering (AML), fraud detection, and more! It provides a more comprehensive and accurate view of a customer or business’ financial situation that isn’t found elsewhere.

Top 5 Benefits of Enrichment

- Actionable Intelligence

The ability to access granular level details and go beyond simple categorizations is a major benefit of data enrichment. Insights take an existing data or dataset and dives deeper, giving you the intelligence to identify opportunities or gaps that you can act upon immediately.

- Real-Time Reporting

The speed, efficiency, and accuracy of reporting are another top benefit of enrichment. All of the relevant information you need when assessing a customer or business can be available in one report, whether it comes from Flinks or your own reporting tool/framework. This can help underwriters immediately make decisions to pre-qualify, lenders can better assess risk, and so on. Reporting does the manual work of collecting and analyzing the financial data for you, saving time and resources that can be devoted elsewhere.

- Flexible Integration

Whether the data aggregator you use is with Flinks, a data aggregator you already have, or even PDFs, the beauty of data enrichment is the simplicity and flexibility of implementing it. You can easily layer an enrichment solution on top of any data source and start enjoying the benefits of actionable insights almost immediately.

- Tailored Insights

When working with companies such as Flinks that offer an 1800+ attributes library, you’ll be able to start generating customizable reporting with insights tailored to your specific needs. With a customized or specific-use case attributes library, you can quickly transform and extract the raw data you need with the highest levels of accuracy.

- Automation

Hours that would otherwise be spent manually collecting and filtering through raw data can instead be automated, reducing the time and resources required to complete back-office tasks. With exceptional accuracy rates and real-time updates, the consistency and reliability of your data-driven insights will noticeably improve.

Conclusion

As the financial industry continues to digitize, an immense amount of raw data is being captured and collected. Raw data is a goldmine of valuable information and potential opportunities. Enrichment, true to its name, takes this raw data and turns it into easy to digest and actionable insights.

When combined with reporting tailored to your needs, you can tap into this goldmine of information and reap the benefits, without any added work. With higher levels of accuracy and targeted insights, financial data enrichment helps improve data-driven decision making, increase operational efficiency, and spearhead product innovation.

You might also like

See how cash flow data opens up new opportunities for lenders to extend access to credit while reducing risks. Read more.

Flinks Enrichment has expanded its analytics capabilities by including a set of core life event data to support various use cases. Read more.